Time Of Day

Table of Contents

Understanding the Time of Day Filter

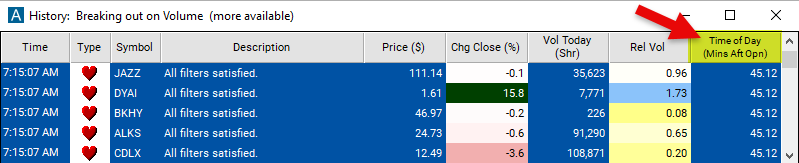

The time of day filter allows traders to specify a particular time after the market open to filter data. This is the number of minutes after the open.

- 0 means exactly the open.

- 1 means one minute after the open.

- 60 means one hour after the open.

- 0.1 means six seconds after the open.

- -1 means one minute before the open.

Time of Day Filter Settings

Configuring the "Time of Day" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

- Set the minimum value to 30 to see only stocks where a specific alert occured at least 30 minutes after the open.

Using the Time of Day Filter

The "Time of Day" filter can be used in various ways, including:

-

Traders may use the time of day filter to analyze price movements, volume, or other trading metrics at specific time intervals after the market open.

-

For example, traders may be interested in studying price volatility in the first 15 minutes after the market open or analyzing volume spikes one hour into the trading session.

-

By setting the filter to different time intervals, traders can identify patterns, trends, or trading opportunities that occur during specific periods of the trading day.

FAQs

What is the significance of analyzing trading data at specific times of the day?

- Analyzing trading data at specific times of the day allows traders to identify patterns, trends, and trading opportunities that may occur during different periods of the trading session. It helps traders understand how market dynamics evolve over time and adjust their trading strategies accordingly.

How do I use the time of day filter effectively in my trading strategy?

- To use the time of day filter effectively, traders should first determine which time intervals are most relevant to their trading strategy. They can then apply the filter to analyze price movements, volume, or other trading metrics during those specific time periods. Experimentation and backtesting can help traders refine their use of the filter over time.

What are some common time intervals traders focus on when using the time of day filter?

- Traders commonly focus on specific time intervals after the market open, such as the first 15 minutes, 30 minutes, or one hour of the trading session. These time intervals are often associated with increased volatility, trading volume, or the emergence of trading patterns and can provide valuable insights for traders.

Filter Info for Time Of Day [Time]

- description = Time of Day

- keywords =

- units = Minutes after the open

- format = 2

- toplistable =

- parent_code =