S&P Change Today

Table of Contents

- Understanding the SPY Change Today Filter

- SPY Change Today Filter Settings

- Using the SPY Change Today Filter

- FAQs

Understanding the SPY Change Today Filter

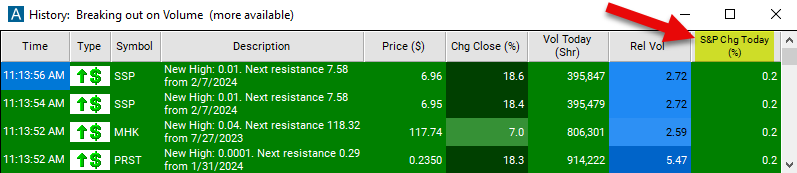

This filter describes how quickly the market as a whole is moving, and in which direction.

This filter is different from most filters, because they are not specific to any one stock. At any given time all stocks get the same answer for this filter.

The SPY filters track the S&P 500.

These filters compare the current price of the index the previous day’s close. The historical price is always precise to the minute. The current price is based on the most recent print.

This filter is primarily meant for use with the OddsMaker and other forms of automated trading. This allows you to set up multiple types of strategies in advance. You can run some strategies when the market is going up, and others when the market is going down.

This filter is available before, after, and during regular market hours.

Here's how the "S&P Change Today" filter works:

Real-Time Monitoring: The filter continuously monitors the price movements of stocks listed on the S&P 500 exchange in real-time, analyzing data over 24-hour intervals.

Identification of Significant Changes: When the filter detects stocks that have experienced a significant change in price over the past day it generates an alert to traders. This alert indicates potential trading opportunities resulting from daily price movements.

SPY Change Today Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window. Use a positive number to see a market which is moving up. Use a negative number to see a market which is moving down. For example, set the max to 0.05 and the min to -0.05 to see a market which is very flat. Use a min of 0.15 to see a market which is moving up. Use a max of -0.15 to see a market which is moving down.

These filters are all measured in percent, not dollars. Some people use an index to watch the market. Other people use the futures, the e-mini futures, or an ETF. These will all have different values, but the percent change will be the same for all of them.

Using the SPY Change Today Filter

Several trading strategies can be employed with the S&P Change Today filter to capitalize on medium-term price movements. Here are some common strategies:

Momentum Trading: Identify stocks that have experienced a significant increase in price throughout the trading day. Enter long positions on these stocks, anticipating that the momentum will continue for the remainder of the trading session.

Reversal Trading: Look for stocks that have experienced a sharp decline in price earlier in the trading day but are now showing signs of recovery. Enter long positions if the stocks exhibit reversal patterns or indications of a potential bounce back from oversold conditions.

Breakout Trading: Monitor stocks that have broken out of key resistance levels or trading ranges during the trading day. Enter long positions on these breakout stocks, expecting the price to continue rising as momentum builds and traders react to the breakout.

Volatility Trading: Trade stocks that have exhibited high volatility throughout the trading day. Look for stocks with wide price swings and enter positions based on short-term price fluctuations, aiming to capitalize on volatility-driven opportunities.

Intraday Scalping: Take advantage of short-term price movements and fluctuations within the trading day. Enter and exit positions quickly based on signals generated by the S&P Change Today filter, aiming to capture.

FAQs

How does the S&P Change Today filter work?

- The S&P Change Today filter monitors stocks listed on the S&P 500 exchange in real-time, analyzing price movements over 24-hour intervals. It identifies stocks that have experienced significant price changes within this timeframe, generating alerts for potential trading opportunities.

Can I use the filter for both long and short trades?

- Yes, the S&P Change Today filter can be used to identify both long and short trading opportunities based on the direction of significant price changes.

Can the filter be used in conjunction with other technical indicators?

- Yes, traders often combine the S&P Change Today filter with other technical indicators, such as moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence), to validate signals and enhance trading decisions. Using multiple indicators can provide a more comprehensive analysis of market conditions and increase the reliability of trading signals.

Filter Info for S&P Change Today [SpyD]

- description = S&P Change Today

- keywords =

- units = %

- format = 1

- toplistable =

- parent_code = Qqqq5