Smart Stop

Table of Contents

- Understanding the Smart Stop Dollar Filter

- Smart Stop Dollar Filter Settings

- Using the Smart Stop Dollar Filter

- FAQs

Understanding the Smart Stop Dollar Filter

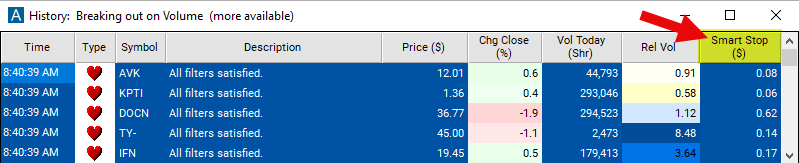

The Smart Stop is a proprietary risk management filter created by Trade-Ideas. It helps traders identify a custom stop loss exit point for trades made at the time the alert was triggered. A stop loss is an order placed with a broker to sell a stock when it reaches a certain price, designed to limit a trader's loss on a position. This exit point is unique to each symbol based on the stock’s volatility, relative volume and daily range. This exit point is unique to each symbol based on the stock’s volatility, relative volume and daily range. By using the smart stop filter, traders can adapt their risk management strategy to changing market conditions and reduce the risk of significant losses during volatile trading periods.

This stop loss filter is expressed in terms of dollars.

Smart Stop Dollar Filter Settings

Configuring the "Smart Stop ($)" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

-

Adjust the minimum value to .10 to see only stocks with a stop loss of $0.10 or more.

-

Adjust the maximum value to 1 to see only stocks with a stop loss of $1 or less.

Using the Smart Stop Dollar Filter

The "Smart Stop ($)" filter can be used in various trading strategies, including:

Fixed Dollar Stop Loss: Traders set a predetermined dollar amount as their maximum acceptable loss for each trade. This fixed dollar amount serves as their stop loss level, and they exit the trade if the price moves against them by that amount. For example, a trader may decide to set a stop loss of $100 per trade, meaning they will exit the position if it moves $100 against them.

Volatility-based Stop Loss: Traders adjust their stop loss levels based on market volatility. They use the stop loss filter to dynamically calculate stop loss distances relative to recent price movements. In high volatility environments, they widen their stop loss orders to accommodate larger price swings, while in low volatility conditions, they tighten their stop loss orders to reduce risk.

Price Action Stop Loss: Traders use price action signals such as candlestick patterns, chart patterns, and trendline breaks to determine optimal stop loss levels. They place their stop loss orders beyond recent swing highs or lows identified by price action analysis. The stop loss filter assists them in calculating the precise distance for stop loss placement based on recent price movements.

FAQs

Should I always use a stop loss?

- While stop losses are crucial for risk management, there may be instances, such as during highly illiquid markets or when trading with very short time frames, where using a stop loss may not be feasible or advisable. Traders should consider their individual circumstances and market conditions when deciding whether to use a stop loss.

What happens if my stop loss is triggered?

- When a stop loss is triggered, the broker automatically executes a market order to sell the security at the specified stop price. This helps limit losses by exiting the position before further adverse price movement occurs.

How often should I review and adjust my stop loss levels?

- Traders should regularly review their positions and adjust stop loss levels as needed based on changes in market conditions, price action, and the evolution of their trading strategy. It's essential to stay vigilant and adapt to changing market dynamics to manage risk effectively.

How do I set the stop loss level using the filter?

- The stop loss filter provides a tool for dynamically calculating the appropriate stop loss level based on predetermined criteria. Traders can adjust the settings of the filter to customize their stop loss placement strategy.

Filter Info for Smart Stop [SmartStopD]

- description = Smart Stop

- keywords =

- units = $

- format = 2

- toplistable = 1

- parent_code =

Smart Stop [SmartStopP]

Smart Stop [SmartStopP]