30 Minute Range

Table of Contents

- Understanding the 30 Minute Range in Percent Filter

- 30 Minute Range in Percent Filter Settings

- Using the 30 Minute Range Percent in Trading

- FAQs about 30 Minute Range in Percent

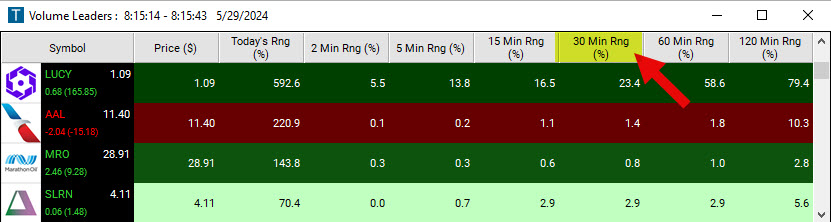

Understanding the 30 Minute Range in Percent Filter

The 30-Minute Range in Percent filter is a tool for active traders who need real-time, precise insights into the short-term volatility of a stock's price.

This filter is calculating the 30 Minute Range of a stock as a percentage of the current price.

The exact formula is: ([Range30]/price)*100

As an example, if the current stock price is $10.00, and the range for the last 30 minutes was $0.10, then you can also say that the range was 1%.

This measure is useful when comparing the volatility of stocks that have very different prices. For example, a $1 change in a $10 stock is a lot more significant than a $1 change in a $100 stock. By converting the range into a percentage, you can make meaningful comparisons across different stocks.

This filter is sensitive to all price movements, so a single price swing, regardless of how significant, can greatly impact the range.

Precise to the minute, the 30-Minute Range Filter constantly updates as time ticks forward. This means at exactly 10:30, the filter will analyze the trades from 10:00 to 10:30. 59 seconds later, at 10:30:59, the server still looks at 10:00 and ends at the current time. 1 second after that, at 10:31, the server looks at all prints between 10:01 and the current time. It always maintains a precise 30-Minute window.

This filter works before, after, and during normal market hours. As long as there's at least one trade within the 30-Minute timeframe, the filter remains operative.

30 Minute Range in Percent Filter Settings

Activating the 30 Minute Range (%) Filter is straightforward. You'll find its settings under the Window Specific Filters Tab in your Alert and Top List Configuration Window.

You can set a minimum and/or maximum value, and stocks that don't fit within your parameters are automatically excluded from your scan results.

-

To find stocks with a 30-Minute Range of at least 1%, add the 30 Minute Range (%) Filter to your scan and enter 1 in the minimum field in the Windows Specific Filters Tab.

-

To find stocks with a 30-Minute Range of no more than 3%, add the 30 Minute Range (%) Filter to your scan and enter 3 in the maximum field in the Windows Specific Filters Tab.

-

To find stocks with a 30-Minute Range between 1.5% and 2.5%, add the 30 Minute Range (%) Filter to your scan and enter 1.5 in the minimum field and 2.5 in the maximum field in the Windows Specific Filters Tab.

Using the 30 Minute Range Percent in Trading

Here are a few ways traders could use the insights from the 30 Minute Range (%) Filter:

- Identifying High Volatility Stocks: Stocks with a high percentage value for this filter indicate a significant price movement within a short 30-Minute time frame. Traders who thrive on high volatility for trades, may use this filter to identify potential trading opportunities.

- Comparing Volatility Across Stocks: By transforming the price range into a percentage, traders can compare volatility across stocks regardless of their price levels. This allows for a fair comparison between a low-priced and a high-priced stock. A $1 price movement in a $10 stock (10% change) is much more significant than a $1 price change in a $100 stock (1% change).

- Filtering Out Less Volatile Stocks: Traders could set a minimum threshold for this filter to exclude stocks that are not moving enough to meet their trading strategy's needs. For example, a day trader might only want to trade stocks that have moved at least 1% in the last 30 minutes.

- Evaluating Breakouts or Breakdowns: Large percentage movements might indicate a breakout or breakdown, key events for many trading strategies. For example, if a stock's price range in the last 30 minutes is significantly higher than what's typical for that stock, it might suggest the beginning of a significant price move.

FAQs about 30 Minute Range in Percent

Can this filter be used for stocks across all price ranges?

Yes, it can be used for stocks across all price ranges. This is one of the advantages of the filter - because it expresses the range as a percentage of the stock's price, it can be used to compare volatility between low-priced and high-priced stocks, which would be difficult with a simple price range.

What is the difference between the 30 Minute Range in Dollar Filter and the 30 Minute Range in Percent Filter? When would a trader use which filter, and what are the advantages and disadvantages respectively?

The two filters help traders evaluate stock volatility, but they provide different types of information and are used in different contexts.

30 Minute Range (%) Filter:

- Enables comparison across stocks with differing price levels.

- Makes it easier to identify stocks with significant price movements in relation to their value.

- Percentage change might be skewed for stocks with very low prices.

- The context of actual dollar movements is lost, which might be relevant for certain trading strategies or risk management.

30 Minute Range ($) Filter:

- Gives a clear, easy-to-understand measure of the price movement in dollar terms.

- Useful for strategies based on absolute price movements.

- Doesn't account for the relative size of the movement, which could make comparisons across different stocks misleading.

- Stocks with higher prices will generally have larger ranges, which could bias the results towards high-priced stocks.

A trader would use the 30 Minute Range (%) Filter when they are interested in the volatility of a stock relative to its price, and use the 30 Minute Range ($) Filter when they are interested in the absolute dollar movement of the stock. The choice of filter will depend on the specific goals, strategy, and risk tolerance of the trader.

Is the 30 Minute Range in Percent filter useful for longer-term trades?

The 30 Minute Range in Percent filter is primarily designed for short-term, intraday trading strategies like scalping and high-frequency trading. Its usefulness may diminish for longer-term strategies as other factors like overall market trends, company fundamentals, and broader economic indicators become more important.

Is there a difference between the the various Range in Percent Filters or do they all work exactly the same way?

Yes, there is a difference. The 2 Minute Range (%) Filter is precise to the second, whereas the 5 to 120 Minute Range (%) Filters are precise to the minute.

Does the 30 Minute Range in Percent Filter work well during high volatility market conditions, such as during market open or close?

Yes, the 30 Minute Range in Percent Filter can be especially useful during high volatility periods, such as the market open or close. However, during these periods, price movements can be extremely rapid and unpredictable. While the filter will help identify stocks with large price movements, traders should be cautious and use additional indicators to confirm signals.

Filter Info for 30 Minute Range [Range30P]

- description = 30 Minute Range

- keywords = Fixed Time Frame

- units = %

- format = 1

- toplistable = 1

- parent_code = Range2