120 Minute Range

Table of Contents

- Understanding the 120 Minute Range in Dollar Filter

- 120 Minute Range in Dollar Filter Settings

- Using the 120 Minute Dollar Range in Trading

- FAQs about 120 Minute Range in Dollars

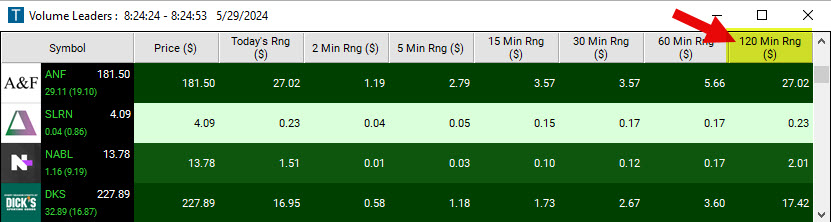

Understanding the 120 Minute Range in Dollar Filter

The 120-Minute Range in Dollar filter is a tool for active traders who need real-time, precise insights into the shorter-term volatility of a stock's price.

This filter calculates the difference between the highest and lowest prices a stock has traded within the last 120-Minute time period.

As an example, if a stock hits a peak of $10.50 and a low of $9.30 within a specific 120-Minute interval, the 120 Minute Range in Dollar Filter would return $1.20.

This filter is sensitive to all price movements, so a single price swing, regardless of how significant, can greatly impact the range.

Precise to the minute, the 120-Minute Range Filter constantly updates as time ticks forward. This means at exactly 10:30, the filter will analyze the trades from 8:30 to 10:30. 59 seconds later, at 10:30:59, the server still looks at 8:30 and ends at the current time. 1 second after that, at 10:31, the server looks at all prints between 8:31 and the current time. It always maintains a precise 120-Minute window.

This filter works before, after, and during normal market hours. As long as there's at least one trade within the 120-Minute timeframe, the filter remains operative.

120 Minute Range in Dollar Filter Settings

Activating the 120 Minute Range ($) Filter is straightforward. You'll find its settings under the Window Specific Filters Tab in your Alert and Top List Configuration Window.

You can set a minimum and/or maximum value, and stocks that don't fit within your parameters are automatically excluded from your scan results.

-

To find stocks with a 120-Minute Range of at least $1.60, add the 120 Minute Range ($) Filter to your scan and enter 1.6 in the minimum field in the Windows Specific Filters Tab.

-

To find stocks with a 120-Minute Range of no more than $8, add the 120 Minute Range ($) Filter to your scan and enter 8 in the maximum field in the Windows Specific Filters Tab.

-

To find stocks with a 120-Minute Range between $1.45 and $5.95, add the 120 Minute Range ($) Filter to your scan and enter 1.45 in the minimum field and 5.95 in the maximum field in the Windows Specific Filters Tab.

Using the 120 Minute Dollar Range in Trading

The 120-Minute Range in dollar filter is a versatile tool that can provide valuable insights for a wide range of trading strategies. The ability to set minimum and maximum values for the filter allows traders to customize the tool according to their unique risk tolerance and strategic goals.

FAQs about 120 Minute Range in Dollars

Can this filter be used for stocks across all price ranges?

Technically, yes. However, the significance of the 120-Minute Range may vary with the price of the stock. For example, a $0.10 range might be highly significant for a $2 stock but less so for a $200 stock. Therefore, you might want to adjust the filter parameters or the way you interpret the results based on the general price range of the stocks you're interested in. Alternatively, use our 120-Minute Range in % Filter to gain insights.

Is there a way to compare the 120-Minute Range to the Daily Range of a stock?

You can create a simple ratio formula to see how the 120 Minute Range contributes to the total day's range with the help of our Formula Editor.

The formula you could use is: [Range120]/[TRangeD]

This formula will give you the fraction of the total day's range that is accounted for by the 120 Minute Range. This comparison can give you a sense of how much short-term volatility is happening compared to the total day's volatility.

If you wanted to return a percentage instead of a ratio, you would use the following formula instead:

([Range120]/[TRangeD])*100

For example, let's say that the price of the stock varied by $5.50 throughout the day and the price of the stock varied by $2.50 in a specific 120-Minute interval. The calculation would then be:

$2.50/$5.50 = 0.45 or 45%

This means that the 120 Minute Range represents 45% of the total day's range, indicating significant short-term volatility during that specific 120-Minute interval.

A higher ratio (i.e., closer to 1 or 100%) suggests that a significant part of the day's price movement is happening within 120-Minute intervals, which might indicate a higher level of short-term volatility. Conversely, a lower ratio (i.e., closer to 0) suggests that the 120-Minute price movements contribute less to the overall day's range, potentially indicating lower short-term volatility.

This ratio could be used to inform your trading decisions based on your trading strategy and tolerance for volatility. For example, if you are a short-term trader who is looking for stocks with high volatility, you might look for stocks with a high 120-Minute Range to Daily Range ratio.

This is just one simple way to compare these two measures, and you may want to consider using additional technical indicators or analysis methods for a more comprehensive view of the market.

Is there a difference between the the various Range in Dollar Filters or do they all work exactly the same way?

Yes, there is a difference. The 2 Minute Range ($) Filter is precise to the second, whereas the 5 to 120 Minute Range ($) Filters are precise to the minute.

Can I use the 120 Minute Range in Dollar filter for pre-market and after-market trading?

Yes, the filter operates during pre-market and after-market hours, as well as during normal market hours. However, you should note that volume is typically lower outside normal market hours, which can impact volatility and price movements.

Filter Info for 120 Minute Range [Range120]

- description = 120 Minute Range

- keywords = Fixed Time Frame

- units = $

- format = p

- toplistable = 1

- parent_code = Range2