Position in Lifetime Range

Table of Contents

- Understanding the Position in Lifetime Range Filter

- Position in Lifetime Range Filter Settings

- Using the Position in Lifetime Range Filter

- FAQs

Understanding the Position in Lifetime Range Filter

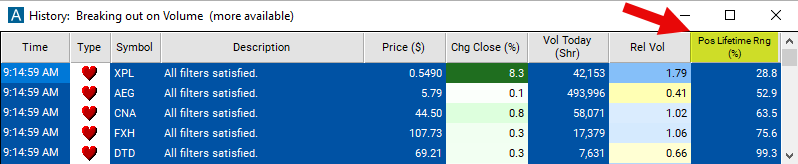

The "position in lifetime range" filter is used to evaluate where the current price of a stock stands relative to the stocks history. This range is fixed at yesterday’s close. The range goes back 10 years or the lifetime of the stock. This filter helps traders assess the recent price movement of a stock and identify potential trading opportunities based on its position within this range.

Here's how the "position in lifetime range" filter works:

Calculation of Lifetime Range: The filter calculates the price range of the stock over the past 10 years or it's lifetime. This range typically spans from the lowest price (low) to the highest price (high) traded during this period.

Position Calculation: Next, the filter determines the position of the current price within it's lifetime. This calculation is expressed as a percentage, indicating how far the current price is from the lowest or highest price of it's history.

This uses the same scale as the other position in range filters. 0% means that the stock is currently trading at the lowest price that it has traded in it's lifetime. 100% means that the stock is trading at the highest price of that time frame.

The column for this scan will be displayed as a graphical indicator. To view the percentage, simply right-click on the column and deselect the option labeled "Graphical Indicator."

If you opt to utilize the graphical indicator, here's a brief overview of the various types of graphics and their corresponding meanings:

=

=

=

=

=

=

Position in Lifetime Range Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here is how to setup the filter in your configuration window:

- Set the minimum value to 25 to see stocks which are at least 25% above the low of its lifetime range.

Using the Position in Lifetime Range Filter

Several trading strategies can be employed with the Position in Lifetime Range filter. Here are a few examples:

Breakout Trading: Traders monitor stocks that are trading near the high or low of the lifetime range. A breakout above the range's high could signal a bullish breakout, prompting traders to consider long positions. Conversely, a breakout below the range's low may indicate a bearish breakout, leading traders to consider short positions.

Trend Confirmation: Traders assess the position of the current price within the lifetime range to confirm existing trends. If the price consistently stays near the high or low of the range during an uptrend or downtrend, respectively, it suggests that the trend is still intact. Traders may consider entering positions in alignment with the trend.

Reversal Trading: Contrarian traders look for stocks that have moved significantly away from the high or low of the lifetime range, indicating potential overbought or oversold conditions. Reversal signals near the range's extremities, such as bearish or bullish candlestick patterns, may prompt traders to anticipate a reversal back towards the mean.

Range Trading: Traders identify stocks trading within the lifetime range and aim to capitalize on price oscillations within this range. They may initiate long positions near the range's low and short positions near the high, intending to profit from price reversals back towards the range's midpoint.

FAQs

What does the "position in lifetime range" filter indicate?

- This filter indicates the current position of a stock's price within its price range over its entire trading history. It helps traders assess whether the current price is closer to the all-time high or all-time low, providing insights into long-term price momentum.

Why is the "position in lifetime range" filter important in trading?

- This filter is important because it helps traders gauge long-term price momentum and identify potential trading opportunities. It provides insights into whether the stock is trading near its all-time highs or lows, which can be useful for determining potential breakout or reversal points.

Can the "position in lifetime range" filter be used for both short-term and long-term trading strategies?

- While primarily focused on long-term trends, the filter can provide valuable context for both short-term and long-term trading strategies. Short-term traders may use it to gauge the strength of longer-term trends, while long-term investors may use it to inform their investment decisions.

How should traders interpret different positions within the lifetime range?

- Traders may interpret a position closer to the all-time high as indicating bullish sentiment or buying pressure, while a position closer to the all-time low may suggest bearish sentiment or selling pressure. However, interpretation may vary based on other factors such as volume and market conditions.

Filter Info for Position in Lifetime Range [RL]

- description = Position in Lifetime Range

- keywords =

- units = %

- format = 1

- toplistable = 1

- parent_code =