Change Post Market

Table of Contents

- Understanding the Change Post Market Dollar Filter

- Change Post Market Dollar Filter Settings

- Using the Change Post Market Dollar Filter

- FAQs

Understanding the Change Post Market Dollar Filter

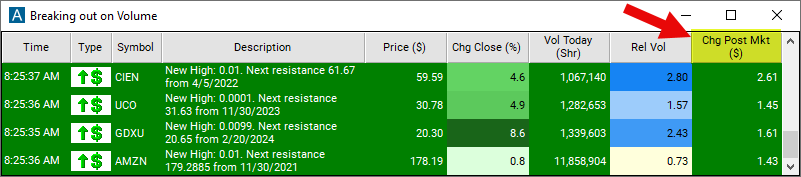

The "change post-market ($)" filter refers to the difference between the current price of a stock and its closing price from the post-market trading session, measured in dollars. This filter provides traders with information about how much the stock price has moved since the end of the regular trading session.

Change Post Market Dollar Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here is how to setup the filter in your configuration window:

- Set the min value to 0.75 to see only stocks which are trading at least 75 cents above where they were at the end of the regular trading session.

Using the Change Post Market Dollar Filter

Several trading strategies can be employed with the Change Post Market Dollar filter. Here are a few examples:

Overnight Momentum Trading: This strategy involves identifying stocks with significant price movements in the post-market session and entering trades to capitalize on the momentum continuation into the next trading day. Traders can screen for stocks with large changes post-market and look for patterns indicating strong momentum. They may then enter long or short positions at the market open, depending on the direction of the price movement.

Gap Trading: Gap trading involves trading stocks that exhibit price gaps between the previous close and the next day's open, often caused by significant news or events occurring after hours. Traders can use the "change post-market ($)" filter to identify stocks with large price gaps between the post-market close and the next day's open. They may then enter trades to exploit the price movement as the market reacts to the overnight news or events.

Reversal Trading: Reversal traders aim to profit from price reversals that occur after significant moves in one direction. Traders can use the "change post-market ($)" filter to identify stocks that have experienced extreme price movements after hours. If the price movement appears overextended or unsustainable, traders may anticipate a reversal and enter trades in the opposite direction.

FAQs

Why is the "change post-market ($)" filter important in trading?

- The "change post-market ($)" filter provides traders with valuable information about price movements occurring after the regular trading hours. It helps traders assess the impact of post-market activity on stock prices and identify potential trading opportunities or trends.

How is the "change post-market ($)" calculated?

- The calculation involves subtracting the closing price of the stock from the post-market session from the current price to determine the dollar amount by which the price has changed.

What does a positive/negative "change post-market ($)" indicate?

- A positive "change post-market ($)" indicates that the current price of the stock is higher than the closing price from the post-market session, while a negative change indicates that the current price is lower.

Filter Info for Change Post Market [PostD]

- description = Change Post Market

- keywords =

- units = $

- format = p

- toplistable = 1

- parent_code =

Change Post Market [PostP]

Change Post Market [PostP]