Put Volume Today

Table of Contents

- Understanding the Put Volume Today Filter

- Put Volume Today Filter Settings

- Using the Put Volume Today in Trading

- FAQs about Put Volume Today

Understanding the Put Volume Today Filter

The Put Volume Today Filter enables traders to scan for stocks based on the number of puts traded so far today. This filter checks the actual number of contracts, not a percentage.

Put options grant holders the right, but not the obligation, to sell a stock at a certain price (strike price) before a specific date. A trader buying a put believes the stock's price will decrease, while the seller is wagering it will stay the same or go up.

Since buying a put is typically a bearish move, our icon for this points down. Of course, for every buyer, there must have been a seller, so use these with caution.

Put Volume Today Filter Settings

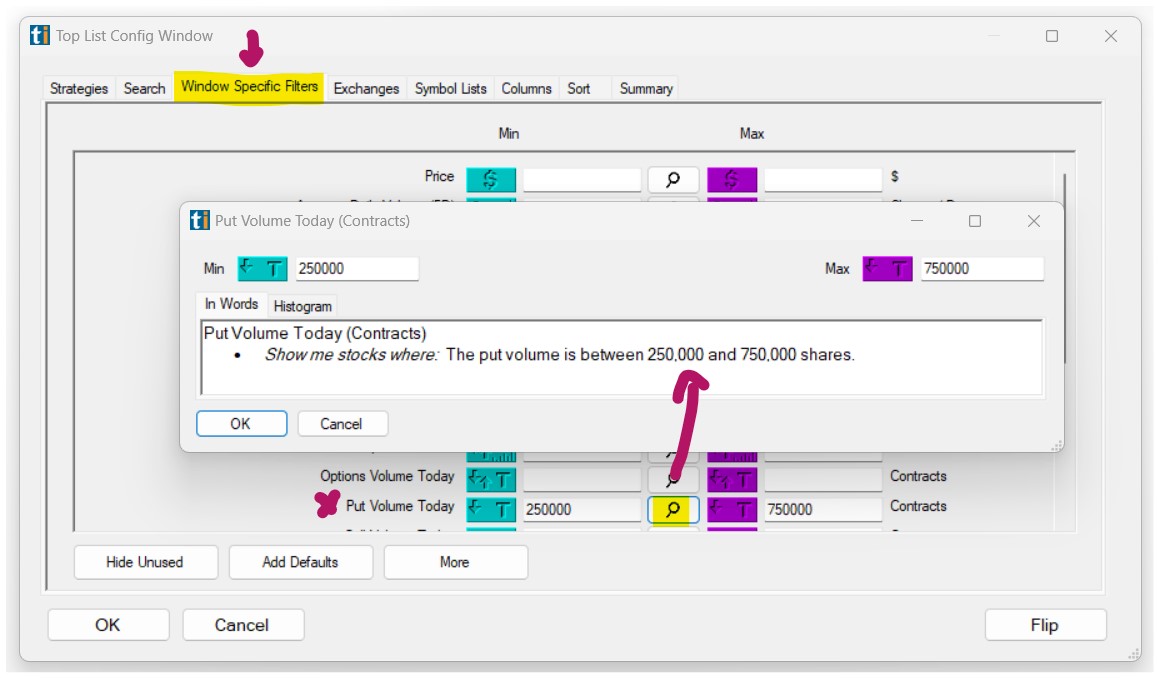

Activating the Put Volume Today Filter is straightforward. You'll find its settings under the Window Specific Filters Tab in your Alert/Top List Window's Configuration Window.

You can set a minimum and/or maximum value, and stocks that don't fit within your parameters are automatically excluded from your scan results.

-

To find stocks that have traded at least 200,000 put options today, add the Put Volume Today Filter to your scan and enter 200000 in the minimum field in the Windows Specific Filters Tab.

-

To find stocks that have traded no more than 50,000 put options, add the Put Volume Today Filter to your scan and enter 50000 in the maximum field in the Windows Specific Filters Tab.

-

To find stocks that have already traded between 250,000 and 750,000 puts today, add the Options Volume Filter to your scan and enter 250000 in the minimum field and 750000 in the maximum field in the Windows Specific Filters Tab.

Using the Put Volume Today in Trading

The Put Volume Today Filter serves as a direct window into the daily activities surrounding put options for stocks. By effectively setting and interpreting the filter's output, traders can gain insights into prevailing market sentiments, aiding in more informed decision-making.

-

Identifying Bearish Sentiment: If a stock displays a significant number of puts traded for the day, it may signal a prevailing bearish sentiment towards that stock among market participants. A trader can delve deeper into the reasons behind this sentiment, such as pending negative news, an upcoming earnings report, or general market sentiment. Armed with this knowledge, they might consider short positions, protective puts if they own the stock, or simply staying away from purchasing the stock until the sentiment is clearer.

-

Detecting Potential Buy Opportunities: A notably low number of puts traded, might signal a lack of bearish sentiment or confidence in the stock's upward potential. This could be an opportune moment to explore bullish strategies like buying the stock, selling put options (if the trader wouldn't mind owning the stock at a lower price), or exploring bullish call option strategies.

-

Pairing with Technical Indicators: If a stock displays high put volume and is nearing a significant support level or showing other bearish technical patterns, this might reinforce the decision to adopt a bearish stance.

-

Sector Analysis: If multiple companies in a sector are showing high put volume, it could indicate a bearish outlook for the entire sector. Consider strategies that hedge against sector-wide declines or avoid long positions within that sector until more clarity is gained.

-

Pairing with Liquidity Filters: Combining the Put Volume Today Filter with liquidity filters can ensure the stocks identified have sufficient trading activity to enter or exit positions without significant price slippage. This is especially vital for traders who deal with large volumes.

-

Identifying Highly Traded Stocks: If a particular stock has an unusually high put volume for the day, it can be an indicator that the stock is currently in the spotlight. This attention might be due to impending news, earnings reports, or industry events. A trader can look for confirmation from other news sources or indicators and decide if the high put volume is an overreaction or a genuine concern.

-

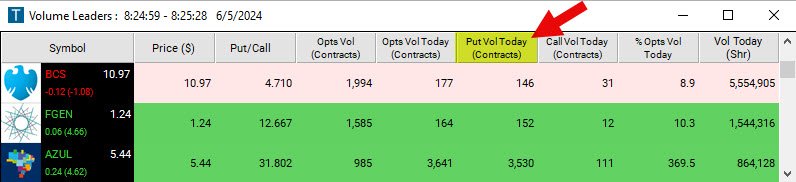

Pairing with Call Option Filters: Combining the Put Volume Today Filter with the Call Volume Today Filter and the Put/Call Ratio Filter will provide a holistic view of the option market's sentiment towards a stock. If a stock has high put volume and comparably high call volume, it's indicative of heightened interest and potential volatility. Traders can then employ strategies suitable for volatile stocks to benefit from price swings in either direction.

FAQs about Put Volume Today

What does a high put volume signify for a stock?

A high put volume for a particular stock indicates that many traders or investors are buying or selling put options for that stock on that specific day. Typically, buying a put option is a bearish move, suggesting an expectation that the stock's price will decline.

Why should I use the Put Volume Today Filter in conjunction with other indicators or filters?

While the Put Volume Today Filter provides raw data on the number of put options traded, combining it with other indicators or filters can offer a more comprehensive understanding of market sentiment and direction. Other filters can provide context or confirmation for the insights gained from the put volume.

Does a high put volume always indicate a bearish sentiment?

No, while buying a put is typically a bearish move, it's essential to remember that for every buyer, there's a seller. It's possible that those selling the puts believe the stock will not drop below the strike price of the put option. Always use additional research and analysis to make informed decisions.

How does the Put Volume Today Filter differ from other volume-based filters?

The Put Volume Today Filter specifically focuses on the number of put options traded for stocks on a given day. It does not provide a percentage comparison or relate to the stock's overall trading volume. This direct approach can be beneficial for traders looking to gauge immediate market sentiment based solely on put option activity.

What happens if both put and call volume is high for a stock on the same day?

This might indicate heightened activity or interest in that stock, possibly due to an upcoming event, recent news, or earnings release. It suggests that the market has a divided sentiment, with some expecting the stock to rise and others expecting it to fall.

How does liquidity impact my decisions based on the Put Volume Today Filter?

Liquidity refers to how easily an asset can be bought or sold without causing a significant price change. If a stock with high put volume has low liquidity, it might be challenging to execute trades at desired prices. High liquidity ensures smoother trade execution and less price slippage.

How can I differentiate between speculative puts and hedging puts?

Speculative puts are bought with the expectation that the stock will decline, while hedging puts are purchased to protect against potential losses in an existing stock position. While the Put Volume Today Filter doesn't differentiate between the two, you might look at other market data, such as open interest, or news surrounding the stock to get a clearer picture.

Is it essential to consider the strike price and expiration date of the puts when looking at the Put Volume Today Filter?

The strike price and expiration date can provide context to the market's sentiment. For example, if there's a high volume of puts with a strike price far below the current stock price and a distant expiration date, it might suggest a long-term bearish outlook rather than a short-term sentiment.

How can I use the Put Volume Today Filter in a trending market versus a sideways market?

In a trending market, especially a downtrend, high put volume can act as a confirmation of the trend. In a sideways market, a sudden spike in put volume might indicate an impending breakout to the downside. Always combine these observations with other technical analysis tools for better accuracy.

Filter Info for Put Volume Today [PTV]

- description = Put Volume Today

- keywords =

- units = Contracts

- format = 0

- toplistable = 1

- parent_code =

Call Volume Today [CTV]

Call Volume Today [CTV]