Position Of Open

Table of Contents

- Understanding the Position of Open Filter

- Position of Open Filter Settings

- Using the Position of Open Filter in Trading

- FAQs about Position of Open

Understanding the Position of Open Filter

The Position of Open Filter compares the open for the day to the previous trading day’s range. Imagine a ruler that measures from the lowest to the highest price of a stock from yesterday. The Position of Open Filter checks where the first price (or opening price) of today's stock falls on that ruler. If it's at the bottom (yesterday's lowest price), it's 0%. If it's at the top (yesterday's highest price), it's 100%.

The formula for this filter is (expected_open-low_p)/(high_p-low_p)*100

expected_openrefers to today’s official open price, or the most recent print if the stock has not opened yet.low_pis the low from the previous day.high_pis the high from the previous day.

Some people call these cases "gapping up" and "gapping down," respectively. We use a different definition of the term "gap," as can be seen in our dedicated Gap Filter section. At Trade Ideas, a gap is defined as the difference between the open price/expected open price and the previous close price, and not the previous high or low.

The Position of Open Filter is similar to the Position in Previous Day’s Range Filter. This filter compares the opening price to the previous day’s range, whereas the latter compares the current price to the previous day’s range. Otherwise, they are the same.

Position of Open Filter Settings

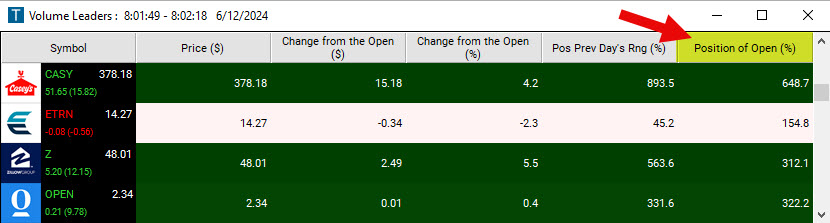

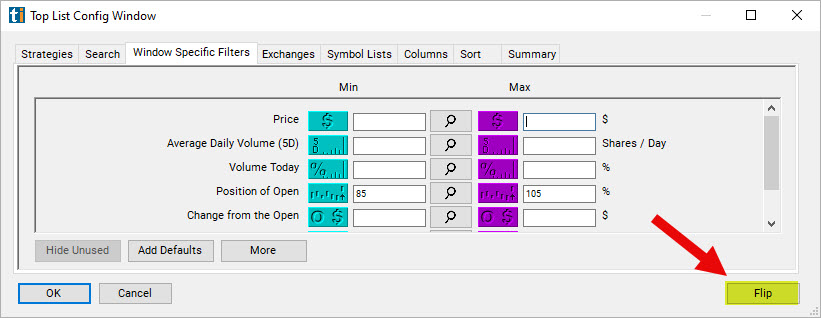

Activating the Position of Open Filter is straightforward. You'll find its settings under the Window Specific Filters Tab in your Alert/Top List Window's Configuration Window.

You can set a minimum and/or maximum value, and stocks that don't fit within your parameters are automatically excluded from your scan results.

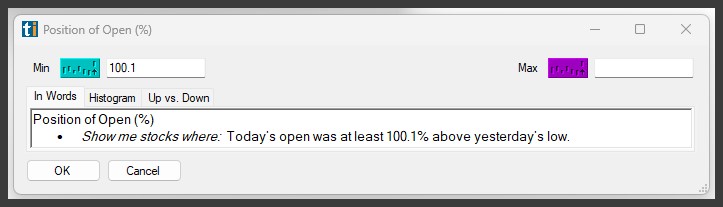

- If you are looking for stocks which opened above yesterday’s high, add the Position of Open Filter to your scan and enter 100.1 in the minimum field in the Windows Specific Filters Tab.

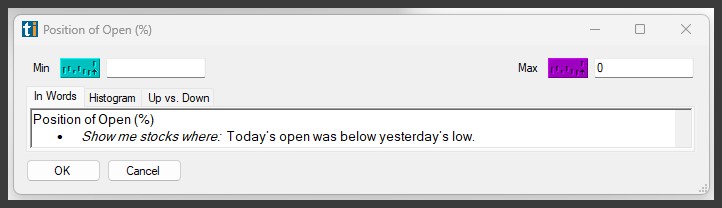

- If you are looking for stocks which opened at or below yesterday’s low, add the Position of Open Filter to your scan and enter 0 in the maximum field in the Windows Specific Filters Tab.

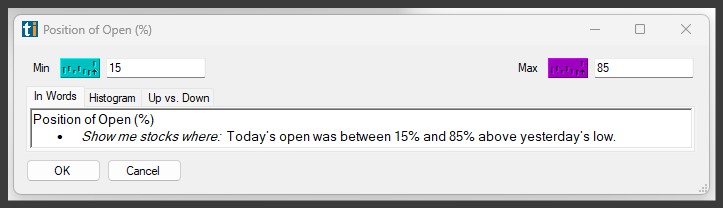

- To find stocks which opened completely inside the previous day’s range (so nowhere near the high or low), add the Position of Open Filter to your scan and enter 15 in the minimum field and 85 in the maximum field in the Windows Specific Filters Tab.

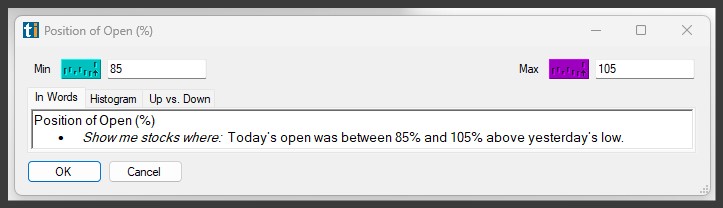

- To find that opened near yesterday's high, add the Position of Open Filter to your scan and enter 85 in the minimum field and 105 in the maximum field in the Windows Specific Filters Tab.

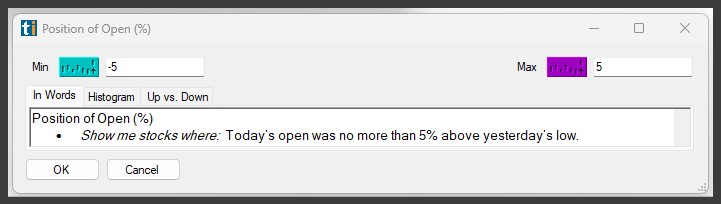

- To find stocks which opened near yesterday's low, enter -5 in the minimum field and 5 in the maximum field in the Windows Specific Filters Tab.

If you have trouble with negative numbers, start by entering the "near highs" example, and then use Trade-Ideas’s "flip" feature to give you the "near lows" case.

Using the Position of Open Filter in Trading

The Position of Open Filter is a simple yet sophisticated tool. Consider the stock market as a massive tug of war between the bulls (buyers) and bears (sellers). When a stock opens near its previous day's high or low, it's like a shout from one side saying, "I have the upper hand today!" This provides a hint about the sentiment surrounding the stock or even the broader market.

- Breakout Watch: Let's say you set the filter to show stocks that opened near yesterday's high (85% to 105% range). That can be an indication of strong bullish sentiment. If the stock maintains this momentum and breaks yesterday's high with significant volume, there's a good chance you've spotted a breakout. This could be an opportunity to go long (buy) expecting further upside.

- Reversal at the Lows: Setting the filter for stocks that opened near the previous day's low (-5% to 5%) can reveal stocks in distress. However, keen eyes will notice opportunities here. If during the day, the stock starts climbing and breaches the previous day's midpoint, it might indicate a bullish reversal. That's your queue to consider a long position.

- Playing the Range: If a stock opens within 15% and 85% of the previous day's range, it might be hinting at a day of consolidation. Day traders can play the highs and lows, buying at support and selling at resistance, capitalizing on the intraday movements.

- Gaps & Continuation: Remember the 'gapping up' and 'gapping down' phenomena? Although here at Trade Ideas we use a different gap definition, these movements are not to be ignored. Stocks that open well above yesterday's high or way below its low are showing strong sentiment. They might continue in the same direction, offering trend-following traders a juicy opportunity.

In trading, knowledge is power, and understanding is profit. So next time you're scanning the markets, give this filter a go. It might just reveal the opportunities you've been missing.

FAQs about Position of Open

How does the Position of Open Filter differ from other filters in terms of reliability?

The Position of Open Filter is essentially a sentiment gauge for a stock's opening relative to the previous day's range. While it's a valuable tool, like all technical indicators and filters, it's most reliable when used in conjunction with other technical tools and analyses. For example, confirming a potential breakout with volume can increase the reliability of a trade setup.

Is the Position of Open Filter suitable for all types of traders, from scalpers to swing traders?

Yes, the Position of Open Filter can be adapted to suit various trading styles. For instance, scalpers might focus on minute-to-minute price changes after the open, especially if the stock opens near the high or low of the previous day's range. On the other hand, swing traders might use this filter to get a sense of the broader momentum and then look for entry points for trades that could last days to weeks.

Can this filter be used for stocks in all sectors or are there specific sectors where it's more applicable?

The Position of Open Filter can technically be applied to stocks in any sector. However, it's worth noting that certain sectors may exhibit more frequent "gapping behaviors" or specific opening tendencies due to industry-related news or events. For instance, biotech stocks might have more pronounced gaps due to regulatory announcements, while tech stocks might react strongly to product launches or quarterly earnings reports.

What are potential pitfalls or misconceptions when using the Position of Open Filter?

A common misconception is that a stock opening near its previous day's high or low is a definitive bullish or bearish signal, respectively. However, stocks can reverse direction even after strong opens. It's essential to use this filter as a starting point and then apply other analytical tools and strategies to confirm trade setups.

In volatile market conditions, does the efficacy of the Position of Open Filter change?

During volatile market conditions, stocks might display more extreme openings relative to their previous day's range. While the Position of Open Filter will still provide valuable insights, traders should exercise added caution. Wider market swings mean potential for higher gains, but also for steeper losses. In such conditions, it's even more crucial to combine this filter with other analytical tools and perhaps set tighter stop-loss orders to manage risk.

How does news and earnings reports impact the values given by the Position of Open Filter?

Significant news events, especially unexpected ones, or company-specific announcements like earnings reports, can result in stocks opening well outside their previous day's range. In such cases, the Position of Open Filter can help identify stocks that are reacting strongly to news. However, it's crucial to understand the context behind such movements and not base decisions solely on the filter's output.

Does the filter work similarly for both large-cap and small-cap stocks?

While the Position of Open Filter can be applied to both large-cap and small-cap stocks, it's worth noting that small-cap stocks often have more pronounced price swings due to their lower liquidity. This can result in more frequent extreme openings relative to the previous day's range. Traders should be mindful of the inherent volatility in small-cap stocks when interpreting the filter's values.

How would the Position of Open Filter behave during market anomalies like flash crashes?

During market anomalies or unexpected events, many stocks might open or move dramatically beyond their usual ranges. The Position of Open Filter can identify these outliers, but it's essential to approach such scenarios with caution. These anomalies can be driven by a mix of algorithmic trading, panic selling, or buying and might not always reflect the true valuation or sentiment around a stock.

Can the Position of Open Filter be combined with volume-based filters for more robust insights?

Yes, combining the Position of Open Filter with volume-based filters can provide a more comprehensive view. For example, a stock that opens near its previous day's high with significantly higher volume than its average might indicate strong bullish sentiment. Conversely, a stock opening near its previous day's low on high volume could signal a potential selloff.

How should traders adjust their risk management when basing trades on the Position of Open Filter?

While the Position of Open Filter gives insight into opening sentiment, it doesn't provide direct information on potential price targets or stop levels. Traders should incorporate other technical analysis tools to determine appropriate risk-to-reward ratios, set stop-loss levels, and identify potential profit-taking zones.

Is there a "best time" during the trading day to apply the Position of Open Filter for maximum effectiveness?

The filter primarily analyzes the opening price in relation to the previous day's range, so its primary utility is at the market's opening. However, understanding where the stock opened can provide context for intraday movements. For instance, if a stock opened near its previous day's high but starts declining rapidly, it might indicate a potential false breakout.

How does the Position of Open Filter react to stocks with less liquidity or thinly traded stocks?

For stocks that are thinly traded or have lower liquidity, the opening price can sometimes be skewed due to lack of volume. This could lead to the Position of Open Filter giving readings that might not truly represent wider market sentiment for that stock. Traders should always cross-check with volume indicators to validate the filter's readings in such cases.

If a stock consistently opens at the extremes of the previous day's range, does it indicate any specific trend or characteristic about the stock?

A stock that consistently opens at the extremes of its previous day's range might be undergoing heightened attention or sentiment shifts. This could be due to company-specific news, sectoral shifts, or broader market trends. It might indicate strong momentum in the stock's direction, but traders should still exercise caution and corroborate with other indicators before drawing conclusions.

In terms of stop-loss placements, how can the Position of Open Filter be integrated into the decision-making process?

While the filter itself doesn't directly inform stop-loss levels, knowing where the stock opened in relation to the previous day's range can provide context. For instance, if trading a stock that opened near its previous day's high, a trader might consider placing a stop-loss below a significant support level from the previous day, ensuring they're out of the trade if the bullish sentiment doesn't sustain.

Trading is as much about the art of interpretation as it is about the science of data analysis. The more layers and perspectives you add to your analysis, the more holistic and informed your trading decisions will become.

Filter Info for Position Of Open [POORP]

- description = Position of Open

- keywords =

- units = %

- format = 1

- toplistable = 1

- parent_code =