Post Market Volume

Table of Contents

- Understanding the Post Market Volume in Shares Filter

- Filter Settings

- Using Post Market Volume in Trading

- FAQs about Post Market Volume in Shares

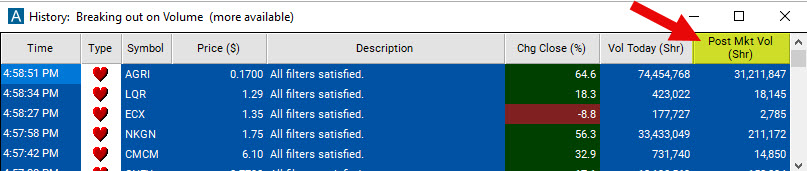

Understanding the Post Market Volume in Shares Filter

The Postmarket Volume in Shares Filter shows how many shares a stock has traded since the market closed today. The filter is active from 16:00 Est until 20:00 Est. Before the close, it will always show a value of 0.

Filter Settings

Activating the Post Market Volume in Shares Filter is straightforward. You'll find its settings under the Window Specific Filters Tab in your Alert/Top List Window's Configuration Window.

You can set a minimum and/or maximum value, and stocks that don't fit within your parameters are automatically excluded from your scan results.

-

To find stocks that are trading at least 20,0000 shares in the post market, add the Post Market Volume in Shares Filter to your scan and enter 20000 in the minimum field in the Windows Specific Filters Tab.

-

To find stocks that have traded no more than 1,000,000 shares afterhours today, add the Post Market Volume in Shares Filter to your scan and enter 1000000 in the maximum field in the Windows Specific Filters Tab.

Using Post Market Volume in Trading

Post-market trading starts at 16:00 Est, after the regular market hours. Trading afterhours can offer a few key benefits:

- Reacting to News: Companies often release earnings and other news after the market closes. The aferhours session gives traders an opportunity to react quickly to these announcements and potentially capitalize on the subsequent price movements. Traders can use post-market volume as an indicator of how significant the market's reaction to the news is.

- Getting a Head Start: If a trader believes that a stock is going to rise in the next trading day, they may decide to trade in the postmarket to buy the stock before the price goes up.

-Price Advantage: In some cases, the lower liquidity and higher volatility of the post-market session can lead to advantageous pricing opportunities that are not available during regular trading hours.

-Flexibility: The extended hours provide flexibility to those who cannot trade during regular market hours due to other commitments.

Post market volume can be a useful tool for traders to analyze the strength or weakness of a stock's price movement. Post market volume should, however, not be used in isolation. It should be used in conjunction with other factors, such as the overall market sentiment, the news flow, and the technical indicators. Be aware of the risks. Post market trading is typically less liquid than regular trading hours. This means that there is a greater risk of large price swings.

FAQs about Post Market Volume in Shares

How much post-market volume is considered significant?

What's considered "significant" volume can vary depending on a variety of factors such as the stock's usual trading volume, market capitalization, and recent news or events. There isn't a one-size-fits-all number as it depends on the specific stock and market conditions. It's recommended to compare the post-market volume to the average volume of the stock for a meaningful analysis.

Which time period does the Postmarket Volume in Shares Filter encompass?

Our extended hours scanning starts after the official close of the market at 16:00 Est and ends at 20:00 Est.

Are there other alerts and filters specifically designed for afterhours trading?

In addition to the Post Market Volume in Shares Filter, the following alerts and filters are specifically designed for extended hour trading, and recommended to be used in combination:

What is the correlation between post-market volume and next day's price movements? Can the filter help predict whether a stock price will open higher, lower, or remain the same?

While high post-market volume can suggest strong investor interest and possibly predict next day's price movement, it's not a guarantee. Many factors influence stock prices. High volume can sometimes precede a price change, but the correlation is not perfectly consistent. Traders should use it alongside other technical indicators and not as a standalone predictor.

Is there an equivalent PreMarket Volume in Shares Filter?

At this point, we don't have a dedicated Premarket Volume in Shares Filter. For pre-market scanning, traders can utilize the Volume Today Filter.

Do you have a filter that can show me yesterday's afterhour volume in shares?

At this point, we only have today's after-hour volume in shares available as a data point.

Filter Info for Post Market Volume [PMVol]

- description = Post Market Volume

- keywords =

- units = Shares

- format = 0

- toplistable = 1

- parent_code =