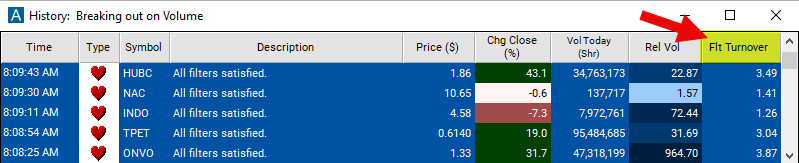

Float Turnover

Table of Contents

- Understanding the Float Turnover Filter

- Float Turnover Filter Settings

- Using the Float Turnover Filter

- FAQs

Understanding the Float Turnover Filter

The "Float Turnover" filter provides a snapshot of today's trading volume relative to the total number of shares available for trading (the float). It is a key metric often utilized by intraday and short-term swing traders to assess significant turnovers in share ownership. When a stock trades multiples of its float, it typically indicates a higher than usual daily volume. In cases where the float data is unavailable, the filter returns a null value. This filter offers valuable insights into the intensity of trading activity and liquidity in a particular stock, aiding traders in identifying potential trading opportunities and market trends.

Calculation: To calculate the float turnover, divide today's trading volume by the float.

Interpretation of Float Turnover: A high float turnover indicates that a significant portion of the stock's float is being actively traded within the specified period. It suggests high liquidity and trading activity, with investors buying and selling shares frequently. Conversely, a low float turnover indicates relatively low trading activity and liquidity in the stock. It may suggest that investors are holding onto their shares for longer periods or that there is less interest or demand for the stock in the market.

Float Turnover Filter Settings

Configuring the "Float Turnover" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

- Adjust the minimum value to 1 to see only stocks with a high float turnover of 1.0 or more.

Using the Float Turnover Filter

The "Float Turnover" filter can be used in various trading strategies, including:

Momentum Trading:

- High Float Turnover: Momentum traders may target stocks with high float turnover ratios, as they indicate intense trading activity and potential short-term price momentum. Traders may initiate trades in the direction of the prevailing trend, aiming to capitalize on rapid price movements driven by increased buying or selling pressure.

- Low Float Turnover: Momentum traders may also target stocks with low float turnover ratios for their potential to experience explosive price moves. These stocks may attract attention from traders seeking short-term opportunities, leading to sharp price fluctuations and momentum swings.

Breakout Trading:

- High Float Turnover: Breakout traders may look for stocks with high float turnover ratios that exhibit significant price movements beyond key technical levels or chart patterns. They may wait for the stock to break out of consolidation phases or trade above resistance levels, aiming to profit from continued momentum and increased trading volume.

- Low Float Turnover: Breakout trading in low float turnover stocks can be particularly lucrative, as they may experience sharp price movements following breakout signals. Traders may use technical indicators and volume analysis to identify potential breakout opportunities and enter trades accordingly.

Scalping:

- High Float Turnover: Scalpers may target stocks with high float turnover ratios for short-term trading opportunities with small profit targets. They may enter and exit trades quickly, taking advantage of rapid price movements and liquidity provided by intense trading activity.

- Low Float Turnover: Scalping low float turnover stocks requires careful risk management due to their potential for volatile price swings. Scalpers may focus on stocks with high relative volume and tight bid-ask spreads, executing trades with precision and efficiency.

FAQs

How is the float turnover ratio calculated, and what does it signify?

- The float turnover ratio is calculated by dividing the total trading volume by the float size of the stock. It signifies the level of trading activity relative to the number of shares available for trading, providing insights into liquidity and market participation.

How does float turnover impact trading strategies and decision-making?

- Traders use float turnover data to identify stocks with high trading activity and liquidity, which can facilitate smoother execution of trades and potentially tighter bid-ask spreads. High float turnover ratios may attract traders seeking short-term trading opportunities or momentum plays, while low float turnover ratios may signal subdued market activity or lack of interest in the stock.

What is considered a high float turnover ratio, and why is it important?

- A high float turnover ratio typically indicates intense trading activity, with a significant portion of the total float being traded within the specified period. It suggests increased liquidity, market interest, and potential trading opportunities. The threshold for what is considered high can vary depending on market conditions and individual stock characteristics.

Filter Info for Float Turnover [FloatTurn]

- description = Float Turnover

- keywords = Single Print

- units = Ratio

- format = 2

- toplistable = 1

- parent_code =