Change From The Open

Table of Contents

- Understanding the Change from Open ATR Filter

- Change from Open ATR Filter Settings

- Using the Change from Open ATR Filter

- FAQs

Understanding the Change from Open ATR Filter

The "change from the open (% of average true range)" filter in stock trading combines two concepts: "change from the open" and "average true range (ATR)." Let's break down each component:

Change from the Open:

This refers to the difference between the current price of a stock and its opening price for the trading session. It indicates how much the price has changed since the market opened.

Average True Range (ATR):

ATR is a measure of volatility that considers the true range of price movement over a specified period. It accounts for the highest high minus the lowest low and can provide insights into the volatility of a stock. Combining these two concepts, the "change from the open (% of ATR)" filter calculates the percentage change from the open price relative to the average true range. This filter helps traders gauge the magnitude of price movement since the market opened relative to the typical volatility of the stock.

This is a way to find daily wide range bars as they happen.

Change from Open ATR Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here is how to setup the filter in your configuration window:

- A large minimum value for this field will find wide range bars for positive stocks. Set the maximum value to a large negative number to find wide range bars in stocks going down today.

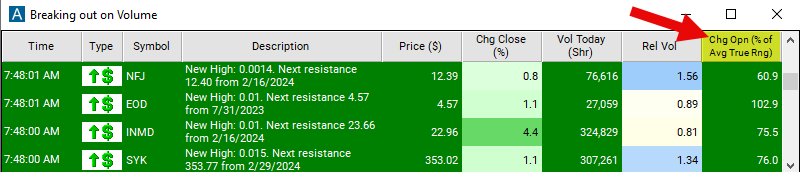

Using the Change from Open ATR Filter

Several trading strategies can be employed with the Change from Open ATR filter. Here are a few examples:

Volatility Expansion Trading: Traders aim to profit from increased volatility in the market. Look for stocks with a large percentage change from the open compared to the average true range. High volatility indicates potential opportunities for profit. Enter trades to capitalize on price movements driven by increased volatility.

Trend Confirmation Trading: Traders confirm the direction of the trend and look for opportunities to join the trend. Use the filter to identify stocks with a significant percentage change from the open in the direction of the prevailing trend. Confirm the trend using other technical indicators or trend-following tools. Enter trades in the direction of the trend to ride momentum.

Mean Reversion Trading: Traders anticipate that price will revert to its mean after significant deviations. Look for stocks with a large percentage change from the open relative to the average true range, indicating overbought or oversold conditions. Wait for signs of reversal such as divergence or exhaustion patterns. Enter trades anticipating a reversion to the mean.

FAQs

What does "change from the open (% of average true range)" signify?

- This filter indicates the percentage difference between the current price of a stock and its opening price for the trading session, relative to the average true range (ATR). It helps gauge the magnitude of price movement since the market opened relative to the typical volatility of the stock.

How is the "change from the open (% of ATR)" filter useful in trading?

- This filter helps traders identify stocks with significant price movements relative to their typical volatility. It can be used to find potential breakout or trend continuation opportunities, as well as to filter out stocks with price movements that are not significant relative to their typical trading range.

Can this filter be used alone or should it be combined with other indicators?

- While it can be used alone, combining it with other indicators like moving averages, trendlines, or volume analysis can enhance its effectiveness and provide more robust trading signals.

Filter Info for Change From The Open [FOW]

- description = Change from the Open

- keywords = Single Print

- units = % of Average True Range

- format = 1

- toplistable = 1

- parent_code = FOD