Decimal

Table of Contents

- Understanding the Decimal Filter

- Decimal Filter Settings

- Using the Decimal Filter in Trading

- FAQs about Decimal Filter

Understanding the Decimal Filter

Think of the Decimal Filter like a magnifying glass for stock prices. Instead of looking at the entire stock price, it zooms in only on the change – the numbers after the decimal point. So, if a stock is priced at $52.89, this filter cares more about the .89 part.

Why Decimals Matter in Trading? Just as we like round figures when negotiating prices in everyday life, the stock market too shows a fondness for whole numbers. Stocks often face resistance or support at these points because many traders set stop-loss orders, take-profit points, or buying orders around these round numbers. For instance, $50, $100, $1,000, etc., are considered more significant than say, $49.57 or $101.23. This filter helps you spot those situations.

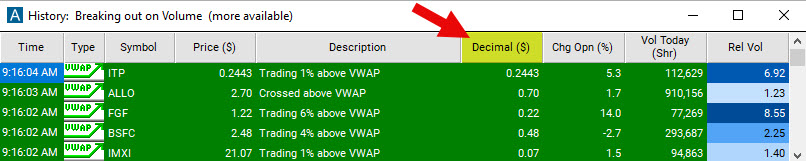

One thing to note: The Decimal Filter is only for Alert Windows – which notify you of stock movements. It won't be in our Top List Windows because those are about ranking stocks, not zeroing in on specific price actions. So, if you're looking to catch actions around exact numbers, this is your tool!

Decimal Filter Settings

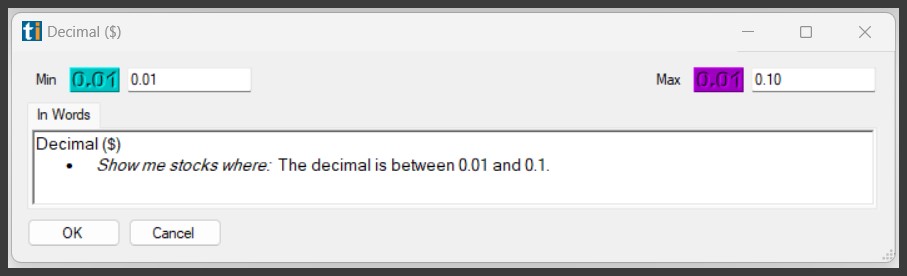

Activating the Decimal Filter is straightforward. You'll find its settings under the Window Specific Filters Tab in your Alert Window's Configuration Window.

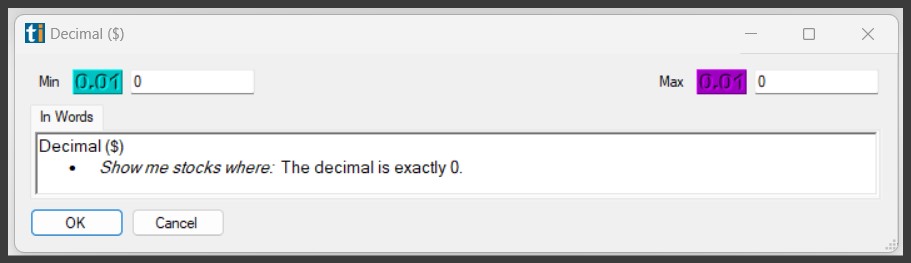

To filter stocks, you will need to fill in both values with a number that is at least 0.00 and less than 1.00.

- Minimum Value: The smallest decimal value you're interested in.

- Maximum Value: The largest decimal value you're interested in.

Examples:

- Whole Numbers Only: If you set both Minimum and Maximum in the Windows Specific Filters Tab to 0, you're saying, "Show me stocks that are exactly at a whole number price." So, stocks at $24.00, $25.00, and so forth.

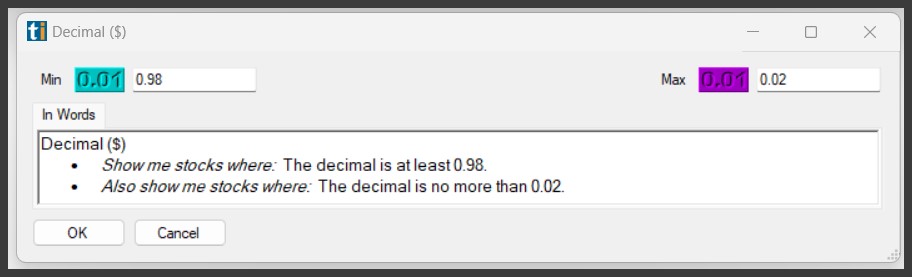

- Near the Whole Number: If you want stocks that are just around a whole number (a little below or a little above), you'd set Min to 0.98 and Max to 0.02. This means you'll see stocks priced from $24.98 to $25.02.

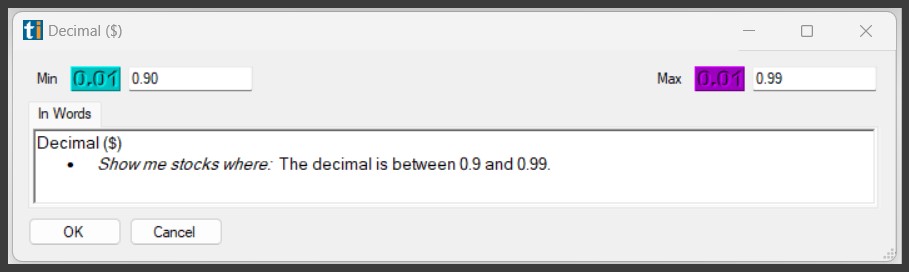

- Approaching the Whole Number from Below: If you're bullish (expecting the stock to rise), and you want stocks that are just below a whole number, you'd set Min to 0.90 and Max to 0.99. This will show you stocks like $24.90, $24.91...up to $24.99. This indicates stocks that are nearing a whole number from below.

- Approaching the Whole Number from Above: If you're bearish (expecting the stock to fall) and you want to see stocks that have just surpassed a whole number but might fall back, set Min to 0.01 and Max to 0.10. This will show you stocks like $25.01, $25.02...up to $25.10.

Using the Decimal Filter in Trading

Why Should You Care About Decimals? The stock market is an ocean, vast and unpredictable, but it has its rhythms. One of the intriguing patterns we've observed over the years is the behavior of stocks near whole numbers. Like a magnet pulling iron filings, whole numbers have a psychological pull on traders. Due to the psychological significance of whole numbers, a lot of trading orders (like stop losses, take profits, or buy/sell orders) tend to cluster around these numbers. This results in an increased level of trading activity near whole numbers, making them potential support or resistance levels. A stock hovering around $29.98 might face resistance at $30.00 because traders set round-numbered price targets. The Decimal Filter allows us to catch these subtleties.

The Decimal Filter, though seemingly simple, opens a realm of strategic trades based on the psychology of whole numbers.

- Breakout/Breakdown Trades: Use the Decimal Filter to identify stocks hovering just below or above a whole number. Stocks nearing from below might break above, while those nearing from above might break below. If you notice strong buying volume and other bullish indicators, it may be a potential breakout candidate.

- Reversal Trades: Stocks that have recently crossed a whole number and are hovering just above may be susceptible to a reversal if they can't maintain their position.

- Scalping Near Whole Numbers: For those who like quick trades, scalping around whole numbers can be profitable. This involves making several trades to capitalize on small price movements around these psychological barriers.

- Setting Stop Losses and Take Profit Points: When entering a trade based on the Decimal Filter, set your stop losses and take profits around these whole numbers. They act as natural barriers, making your trades more secure. But be aware of the cons of this practice described in the FAQ section below.

- Combination with Volume: As mentioned earlier, always check the volume when considering trades with the Decimal Filter. Stocks approaching a whole number with high volume are more likely to break through.

- Combination with Moving Averages: If a stock nearing a whole number is also close to a significant moving average (like the 50-day or 200-day SMA), it adds more weight to the potential price action.

- Combination with RSI (Relative Strength Index): Combining RSI with the Decimal Filter can be insightful. A stock approaching a whole number with an RSI above 70 may indicate it's overbought and could face resistance, while an RSI below 30 might suggest it's oversold and could find support.

As with any strategy, practice makes perfect. Begin by paper trading using this filter, understand its nuances, and once comfortable, integrate it into your live trading. Remember, in the vast world of trading, sometimes the devil (or the angel!) is in the details—or in this case, the decimals.

FAQs about Decimal Filter

Should I set a Stop Loss at a round number?

Setting a stop loss at a round number is a common practice among traders due to the psychological significance of these numbers. However, there are pros and cons to consider:

Pros:

-

Simple and Easy: For traders, especially beginners, setting stop losses at round numbers is straightforward and easy to remember.

-

Psychological Barriers: Round numbers can serve as psychological support or resistance levels. If a stock has shown historical evidence of bouncing off or stalling at these levels, a stop loss at a round number might make sense.

Cons:

-

Predictability: Since many traders place stop orders at or just beyond round numbers, these areas can become targeted. Savvy traders and institutions are aware of this predictability, making these levels susceptible to "stop loss hunting."

-

Potential False Breakouts/Breakdowns: Price might momentarily dip below a round number, triggering your stop loss, and then quickly rebound. This can lead to premature exits from trades.

-

Not Always the Best Technical Level: While round numbers have psychological importance, they might not always align with the best technical levels derived from other indicators like moving averages, trend lines, or Fibonacci levels.

Recommendations:

-

Use a Buffer: Instead of placing a stop loss directly at a round number (e.g., $50.00), consider using a buffer (e.g., $49.85 or $50.15). This can help avoid getting stopped out due to minor price fluctuations around these psychological levels.

-

Combine with Other Indicators: Always consider other technical indicators and the stock's historical price action around round numbers before setting a stop loss. This can give you a more comprehensive view of potential support or resistance levels.

-

Adjust Based on the Stock's Volatility: If a stock is highly volatile, a wider buffer around the round number might be necessary.

-

Stay Informed: If you do place your stop loss at or near a round number, be aware of the potential for increased trading activity at these levels and stay prepared to adjust if necessary.

In conclusion, while round numbers can serve as convenient reference points for stop losses, blindly relying on them without considering other factors can be risky. Always strive for a balanced approach, combining the psychological importance of round numbers with other technical and historical data.

How often do stocks react at these whole number levels?

It's common for stocks to show some form of reaction at whole number levels due to the psychological importance attached to these numbers. Traders and institutions often set orders around these levels, leading to increased buying or selling pressure. However, the frequency and intensity of these reactions can vary based on the stock's volatility, market conditions, and the stock's historical price behavior around these levels.

Is the Decimal Filter effective for all types of stocks, or are there specific stocks or sectors it works best for?

The Decimal Filter is a versatile tool that can be applied across various stocks and sectors. However, it may prove more effective for stocks that have shown historical tendencies to react around whole numbers. Stocks with higher liquidity and trading volume often show clearer reactions at these psychological levels. It's always a good practice to backtest any filter or strategy on different stocks and sectors to gauge its effectiveness.

Can I combine the Decimal Filter with other filters in the Trade Ideas software?

Absolutely! In fact, combining the Decimal Filter with other filters can provide more precise and tailored trading signals. For instance, you might combine it with a volume filter to find stocks that are not only trading near whole numbers but also experiencing a surge in volume. This combination can hint at a potential breakout or breakdown.

How does the Decimal Filter differ from other price-based filters?

While there are many filters that focus on price, the Decimal Filter specifically zooms in on the decimal portion of the stock price, allowing traders to identify stocks trading near whole numbers. This unique focus makes it particularly useful for traders who believe in the psychological significance of round numbers and their influence on stock price movement.

How reliable is the Decimal Filter in predicting future stock movements?

No single filter, including the Decimal Filter, can predict future stock movements with absolute certainty. The Decimal Filter is a tool that helps traders spot potential opportunities based on the theory of psychological price levels. As with any trading tool, its effectiveness will largely depend on the overall market context, the individual stock's behavior, and how it's combined with other trading strategies and tools. Always use the Decimal Filter in conjunction with other analyses and never rely on it solely for trading decisions.

If a stock consistently respects whole numbers, does that guarantee future performance?

No, past performance doesn't guarantee future results. While a stock might have historically respected whole numbers, various factors like changing market conditions, company news, or global events can influence its future behavior. It's essential to remain adaptive and continuously monitor and adjust your strategies based on current market data.

Is the Decimal Filter more effective on shorter or longer timeframes?

The psychological significance of whole numbers applies across various timeframes, but the effectiveness of the Decimal Filter may vary. On shorter timeframes, you might notice more frequent reactions around whole numbers due to intraday trading behaviors. However, on longer timeframes, these levels might serve as more robust support or resistance levels since they encompass more extended periods of trading activity.

Is there a best practice for adjusting stop losses when using the Decimal Filter?

When using the Decimal Filter to identify potential trade entries around whole numbers, consider placing stop losses slightly beyond these numbers to account for potential volatility. As the price moves in your favor, you can employ a trailing stop strategy, moving your stop loss to lock in profits while still giving the trade room to run.

Would the Decimal Filter still be relevant in high-volatility market conditions?

During high-volatility periods, prices can swing dramatically and might breach whole number levels more frequently. While the psychological importance of these levels remains, the Decimal Filter's signals might be more prone to false breakouts or breakdowns. In such conditions, it's crucial to use the Decimal Filter in tandem with other indicators and perhaps employ more conservative settings to filter out excessive noise.

How does news and earnings reports impact the effectiveness of the Decimal Filter?

Significant news or earnings reports can lead to sharp price movements, sometimes making the Decimal Filter's signals less reliable in the short term. During such events, prices might breach whole number levels due to external factors rather than their psychological significance. It's advisable to be cautious and factor in the broader market context when trading around major news using the Decimal Filter.

Are there specific sectors where the Decimal Filter tends to be more effective?

While the Decimal Filter can be used across all sectors, its effectiveness might be more pronounced in sectors where retail investors are more active, given that round numbers hold psychological importance primarily for human traders. In sectors dominated by institutional trading, algorithmic trades might overshadow the effects of psychological price levels.

Would the Decimal Filter's significance diminish with the rise of algorithmic trading?

Algorithmic trading, which relies on pre-programmed instructions to execute trades, doesn't have the psychological biases of human traders. However, given that many algorithms are designed to exploit human behaviors in the market, whole number levels might still be relevant. The key is to understand that while the Decimal Filter is rooted in human psychology, it still plays a role in markets dominated by algorithms.

Does the Decimal Filter work better during specific times of the trading day?

The opening and closing hours of the trading day often see heightened activity. During these times, stocks might experience increased volatility around whole numbers due to higher trading volumes. Being aware of these timeframes can help traders harness the Decimal Filter's potential more effectively.

Can the Decimal Filter be used in conjunction with fundamental analysis?

Absolutely! While the Decimal Filter is a technical tool, it can be combined with fundamental insights. For instance, if a stock is fundamentally strong and is trading near a whole number, the Decimal Filter could help pinpoint a more precise entry or exit point.

Filter Info for Decimal [Dec]

- description = Decimal

- keywords =

- units = $

- format = p

- toplistable =

- parent_code =