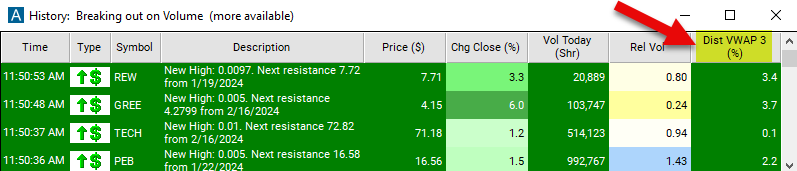

Distance From VWAP 3

Table of Contents

- Understanding the Distance from VWAP 3 Filter

- Distance from VWAP 3 Filter Settings

- Using the Distance from VWAP 3 Filter

- FAQs

Understanding the Distance from VWAP 3 Filter

The Distance from VWAP 3 filter in stock trading refers to a technical analysis tool used by traders to assess how far a stock's current price is from the Volume Weighted Average Price (VWAP) over a specific period. VWAP is a trading benchmark that gives the average price a stock has traded at throughout the day, weighted by volume. This filter compares the last price to the stock's VWAP for the last 3 trading days. This filter uses percentage.

Here's how the distance from VWAP 3 filter works:

Calculation of VWAP: VWAP is calculated by multiplying the price of each trade by the volume of that trade, summing up these values, and dividing the total by the cumulative volume traded over the period. In the case of VWAP 3, it represents the VWAP over the last three trading days.

Identification of Distance from VWAP 3: The distance from VWAP 3 is calculated as the absolute difference between the current stock price and the VWAP for the previous three trading days.

Application in Trading Strategies: Traders use the distance from VWAP 3 filter to make trading decisions. For example:

- If the current price is significantly above VWAP 3, it may suggest bullish sentiment, and traders may look for buying opportunities or expect the price to continue rising.

- Conversely, if the current price is significantly below VWAP 3, it may indicate bearish sentiment, and traders may consider short-selling or exiting long positions.

Distance from VWAP 3 Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here is how to setup the filter in your configuration window:

-

Set the min value to 0.001 to see stocks currently trading above their VWAP 3.

-

Set the max value to -0.001 to see stocks currently trading below their VWAP 3.

Using the Distance from VWAP 3 Filter

Several trading strategies can be employed with the Distance from VWAP 3 filter. Here are a few examples:

Trend Confirmation Strategy: Traders use the distance from VWAP 3 filter to confirm the direction of the trend. If the price consistently remains above VWAP 3, indicating bullish sentiment, traders may consider buying opportunities. Conversely, if the price consistently stays below VWAP 3, indicating bearish sentiment, traders may consider short-selling opportunities.

Mean Reversion Strategy: Traders anticipate that the price will revert to the mean represented by VWAP 3 after a significant deviation. If the price deviates significantly above VWAP 3, traders may anticipate a pullback and look for short-selling opportunities. Conversely, if the price deviates significantly below VWAP 3, traders may anticipate a bounce back towards VWAP 3 and look for buying opportunities.

Breakout Confirmation Strategy: Traders use the distance from VWAP 3 filter to confirm breakout trades. When the price breaks out above VWAP 3 with significant volume, it may indicate a bullish breakout. Traders can buy the stock with the expectation of further upward movement. Conversely, when the price breaks out below VWAP 3 with significant volume, it may indicate a bearish breakout, and traders may consider short-selling opportunities.

FAQs

What is VWAP 3, and how is it calculated?

- VWAP 3 represents the Volume Weighted Average Price calculated over the last three trading days. It is calculated by multiplying the price of each trade by the volume of that trade, summing up these values, and dividing the total by the cumulative volume traded over the three-day period.

What does the distance from VWAP 3 indicate?

- The distance from VWAP 3 indicates how far the current stock price is from the average price at which it traded over the previous three trading days. It provides insights into whether the current price is overvalued or undervalued relative to recent trading activity.

How can traders use the distance from VWAP 3 filter in their trading strategies?

- Traders can use the distance from VWAP 3 filter to identify potential buying or selling opportunities. For example, if the current price is significantly below VWAP 3, traders may look for buying opportunities, anticipating a potential bounce back towards VWAP 3. Conversely, if the current price is significantly above VWAP 3, traders may consider selling opportunities, anticipating a potential pullback towards VWAP 3.

Filter Info for Distance From VWAP 3 [DVWAP3]

- description = Distance from VWAP 3

- keywords = Single Print

- units = %

- format = 1

- toplistable = 1

- parent_code = DVWAP2