Distance From Inside Market

Table of Contents

- Understanding the Distance from Inside Market Filter

- Distance from Inside Market Filter Settings

- Using Distance from Inside Market in Trading

- FAQs about Distance from Inside Market

Understanding the Distance from Inside Market Filter

- Distinguishing legitimate from bad prints -

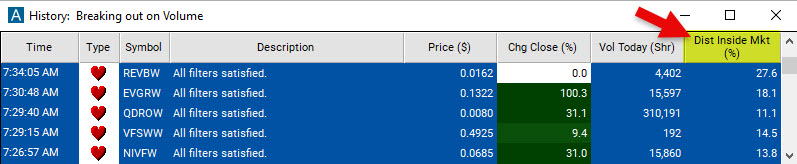

The Distance from Inside Market filter is a useful tool for traders who want to find prices that are likely to be trade-able. It compares the last print for a stock to the National Best Bid and Offer (NBBO)). The NBBO represents the highest bid price and the lowest ask (offer) price available in the market for a particular stock at any given time. It reflects the most competitive prices at which buyers are willing to purchase the stock (bid) and sellers are willing to sell it (offer).

The Distance from Inside Market filter enables you to separate legitimate prints from bad prints. When the last print price is close to the inside market (near the best bid or offer), it indicates a higher level of reliability as it aligns with the prevailing market sentiment and the most competitive prices at that moment.

Conversely, when the last print price is significantly distant from the inside market, it suggests a lower level of reliability. Trades executed far from the NBBO may be considered less significant or potentially influenced by outliers, less liquid markets, or less competitive prices.

This filter helps you to focus on more reliable and meaningful price data, by filtering out trades executed far from the inside market.

At Trade Ideas we use the inside market to validate many of our short-term alerts.

Distance from Inside Market Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

The Distance from Inside Market Filter works by setting a minimum and/or maximum value. Stocks that fall outside of this range will be excluded from the scan results.

-

To find stocks that are trading at or between the bid or offer at the time of the alert, add the Distance from Inside Market Filter to your scan and enter 0 in the maximum field in the Windows Specific Filters Tab.

-

To find stocks that are trading no more than one tenth of one percent above the offer and no more than one tenth of one percent below the bid, add the Distance from Inside Market Filter to your scan and enter 0.1 in the maximum field in the Windows Specific Filters Tab.

Using Distance from Inside Market in Trading

- Gauging the trade-ability of prices -

Considering the distance from the inside market helps traders assess the reliability, liquidity, and realistic nature of stock price alerts.

The inside market is real. It is the price at which someone is willing to buy the stock and the price at which someone is willing to sell it. This is in contrast to an individual print, which is just a single price that was traded at some point in time. Individual prints can be misleading, because they can be very different from the inside market.

For example, there may be just one print at the high price of the day, and 10,000 traders are staring at the chart, wishing they had sold there. But that print was just a fantasy. It does not reflect the true price of the stock. The Distance from Inside Market Filter therefore helps traders gauge the trade-ability of a price.

The Distance from Inside Market Filter is especially helpful when used with the OddsMaker. Our backtester uses the price of the last print as the entry price for the trade. This is only useful if this was a price that you could actually get. The closer the last recorded price is to the inside market, the more realistically attainable it is as an entry price. Therefore, the Distance from Inside Market filter helps you to find stocks where the OddsMaker results reflect live trading conditions.

FAQs about Distance from Inside Market

Are there any limitations or considerations to keep in mind when using the Distance from Inside Market Filter?

When using the Distance from Inside Market Filter, there are some limitations and considerations to keep in mind. These include:

-

Bid-Ask Spread: The bid-ask spread represents the difference between the best bid and offer prices. When the spread is wide, it indicates a less liquid market. The Distance from Inside Market Filter may be less effective in such situations, as the last print may be far from both the bid and offer prices, making it challenging to assess reliability based on distance alone.

-

Trade Execution Speed: The Distance from Inside Market Filter focuses on the last recorded price, which may not always reflect the actual price at which a trade can be executed. Market orders and delays in trade execution can cause the entry price to deviate from the last recorded price. Traders should consider other factors like slippage and execution speed when assessing the suitability of an entry price.

While the Distance from Inside Market Filter provides valuable information, it should be used in conjunction with other technical and fundamental analysis tools. Incorporating additional filters and factors can provide a more comprehensive view of the market.

What is the impact of the Distance from Inside Market filter on slippage?

Slippage refers to the difference between the expected price of a trade and the actual price at which it is executed. Here's how the Distance from Inside Market filter can relate to slippage:

-

Reducing Slippage: By using the Distance from Inside Market filter, traders aim to enter trades at prices that are closer to the inside market. When the last recorded price aligns closely with the bid or offer price, there is generally less room for slippage. This can result in better trade execution and potentially reduce the negative impact of slippage.

-

Realistic Entry Prices: The filter helps traders select entry prices that are more realistic and attainable in the market. By focusing on trades executed close to the inside market, traders increase the likelihood of their orders being filled at or near their desired price. This can minimize slippage, as the trade is executed at a price more in line with the prevailing market conditions.

-

Volatile Market Conditions: In volatile markets, slippage can be more prevalent due to rapid price movements and changing order book dynamics. The Distance from Inside Market filter may be less effective in minimizing slippage during such conditions, as the last recorded price might quickly become outdated. Traders should exercise caution and consider additional risk management measures in highly volatile markets.

It's important to note that slippage can still occur even with the Distance from Inside Market filter in place, as other factors like market orders, order size, and execution speed can impact trade execution. Traders should also consider employing other techniques like limit orders, proper position sizing, and employing risk management strategies to manage slippage effectively.

Which filters complement the Distance from Inside Market Filter in terms of reliability of alerts?

-

Volume Filter: The volume filter complements the Distance from Inside Market filter by providing insights into the strength and confirmation of the alert. The volume filter examines the trading volume associated with a particular alert or price movement. It helps determine the level of market participation and liquidity behind a trade. By comparing the trade volume to average or historical volume levels, traders can gauge the significance and reliability of the alert.

-

Spread Filter: The spread filter helps assess the liquidity and market depth by examining the tightness or wideness of the bid-ask spread. A narrow spread suggests higher liquidity and tighter pricing, indicating a more competitive and reliable market. In contrast, a wide spread may indicate lower liquidity or potentially less reliable pricing. By combining these filters, traders can refine their trade selection process, focusing on trades that not only have a close proximity to the inside market but also exhibit a narrow spread, suggesting a more reliable and favorable trading environment. This comprehensive approach may lead to potentially improved trading outcomes.

-

Time and Sales Data: The time and sales data you can receive from your broker allows traders to identify unusual or irregular trading patterns, such as large block trades, rapid price changes, or suspicious activity. By assessing the time and sales data, traders can filter out potentially manipulated or unreliable trades, enhancing the reliability of alerts.

Filter Info for Distance From Inside Market [DNbbo]

- description = Distance from Inside Market

- keywords = Bid and Ask Single Print

- units = %

- format = 1

- toplistable =

- parent_code =