Bid Size

Table of Contents

- Understanding the Bid Size Filter

- Bid Size Filter Settings

- Using the Bid Size Filter

- FAQs about Bid Size

Understanding the Bid Size Filter

- Analyzing Demand and Liquidity in Stock Trading -

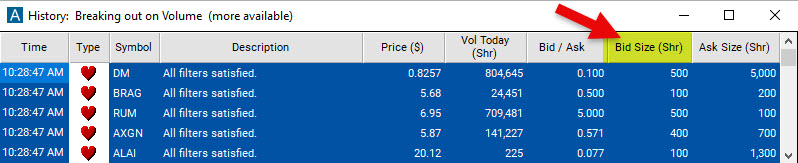

The Bid Size, also known as the Bid Volume, refers to the number of shares that buyers are willing to purchase at a specific bid price.

The classification of a large or low bid size depends on factors like stock liquidity and market capitalization. In highly liquid stocks, a large bid size might be in the thousands or tens of thousands of shares, while for less liquid stocks, it could be in the hundreds of shares.

If the Bid Size is 400, it means that there are buyers willing to purchase 400 shares at the specified bid price. The Bid Size Filter in Trade Ideas utilizes Level 1 market data.

Bid sizes can change rapidly due to order placement, filling, or cancellation.

Comparing the bid size with the ask size helps gauge buying interest and demand levels. See the Bid/Ask Ratio Filter.

Bid Size Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

The Bid Size filter works by setting a minimum and/or maximum Bid Size share value. Stocks with a Bid Size that fall outside of this range will be excluded from the scan results.

To scan for stocks with a minimum Bid Size of at least 1,000 shares, add the Bid Size Filter to your scan and enter 1000 in the minimum field in the Windows Specific Filters Tab.

Using the Bid Size Filter

- Harnessing Buyer Interest -

Here are some examples of different bid sizes traders may consider in their trading:

-

For highly liquid stocks with significant trading volume, a trader might set a minimum bid size of 1,000 shares and a maximum bid size of 10,000 shares. This range ensures that the trader focuses on stocks with substantial demand and liquidity.

-

If the trader is interested in mid-cap stocks, they may set a minimum bid size of 100 shares and a maximum bid size of 1,000 shares. This range is suitable for stocks with moderate liquidity and trading activity.

-

Stocks with extremely large bid sizes may indicate heavy institutional buying or market manipulation, so traders might want to exclude those stock by setting a maximum Bid Size. By excluding higher bid sizes, a trader can focus on stocks where individual traders have a more significant impact on price movements.

-

Traders who engage in short-term trading or scalping strategies often look for stocks with tighter bid-ask spreads and quick price movements. Excluding higher bid sizes may help filter out stocks with slower price action and focus on stocks with more dynamic price changes.

FAQs about Bid Size

What is the difference between bid size and volume?

Bid size is the number of shares that buyers are willing to purchase at a specific bid price, while volume is the total number of shares that have been traded in a given period of time.

How does the bid size filter impact the overall scan results and trading strategies?

The bid size filter can impact the overall scan results and trading strategies in a number of ways. It can help to reduce the number of stocks in the scan results. By setting a minimum bid size, you can focus on stocks with more significant demand and liquidity. This can help to reduce the number of stocks in the scan results and make it easier to identify potential trading opportunities.

It can help to identify stocks with potential for price movement. A large bid size can also indicate that a stock is about to move in price. This is because it shows that there is a lot of buying interest in the stock, which can create upward pressure on the price.

Are there any best practices for determining the appropriate bid size range for different types of stocks?

Yes, there are some best practices for determining the appropriate bid size range for different types of stocks.

-

Consider the liquidity of the stock. Bid size is more meaningful in liquid stocks than in illiquid stocks. This is because the bid size in illiquid stocks is more likely to be affected by the actions of a single large trader. For liquid stocks, a larger bid size may be more meaningful, while for illiquid stocks, a smaller bid size may be more meaningful.

-

Consider the time of day. Bid size can change throughout the day. It is typically higher during peak trading hours and lower during off-peak hours. For example, a larger bid size may be more meaningful during peak trading hours, while a smaller bid size may be more meaningful during off-peak hours.

-

Consider the volatility of the market. Bid size can also change during periods of high volatility. It is typically higher during periods of high volatility and lower during periods of low volatility. For example, a larger bid size may be more meaningful during periods of high volatility, while a smaller bid size may be more meaningful during periods of low volatility.

-

Consider your trading style. If you are a short-term trader, you may want to focus on stocks with smaller bid sizes. This is because smaller bid sizes are more likely to move quickly in price. If you are a long-term trader, you may want to focus on stocks with larger bid sizes. This is because larger bid sizes are more likely to provide liquidity when you want to sell your shares.

Can bid size be used as a standalone indicator for making trading decisions, or should it be combined with other factors?

It is generally recommended to combine the Bid Size indicator with other factors. This is because bid size can be affected by a number of factors, including the liquidity of the stock, the time of day, and the volatility of the market. By combining bid size with other filters, you can get a more complete picture of the market and make more informed trading decisions.

Here are some of the factors that can be combined with bid size:

-

Price Change: The price of a stock can give traders an indication of the overall sentiment towards the stock. For example, if the price of a stock is rising and the bid size is also increasing, this could be a sign that there is strong buying interest in the stock. Check out our various Change filters.

-

Volume: The volume of trading in a stock can give traders an indication of the liquidity of the stock. For example, if the volume of trading in a stock is high and the bid size is also high, this could be a sign that the stock is liquid and easy to trade. Trade Ideas offers a wide range of volume filters for traders of all time frames.

-

Volatility: The volatility of a stock can give traders an indication of the risk associated with the stock. For example, if the volatility of a stock is high and the bid size is also high, this could be a sign that the stock is risky and could experience sharp price movements. For more info, head to our Volatility filter.

Can I use the Bid Size Filter in combination with other filters?

Yes, the Bid Size Filter can be combined with other filters and alerts, allowing you to create more specific and refined scans based on multiple criteria.

How do multiple filters and alerts work together with the Bid Size Filter?

When multiple filters are applied in a scan, they work as "ANDs" meaning that all the filters need to be satisfied by a stock for it to be included in the scan results.

When multiple alerts are used in a scan, they work as "ORs" indicating that only one of the alerts, along with satisfying all the filters, needs to be met for a stock to appear in the scan results.

Do you have step-by-step tutorials on how to build scans?

Please watch the following three short videos on how to create Alert and Top List Windows Scans in Trade Ideas:

Filter Info for Bid Size [BS]

- description = Bid Size

- keywords = Bid and Ask

- units = Shares

- format = 0

- toplistable =

- parent_code = Price