Bid / Ask Ratio

Table of Contents

- Understanding the Bid-Ask-Ratio Filter

- Bid-Ask-Ratio Filter Settings

- Using the Bid-Ask-Ratio in Trading

- FAQs about Bid-Ask-Ratio

Understanding the Bid-Ask-Ratio Filter

- Analyzing Supply and Demand Dynamics -

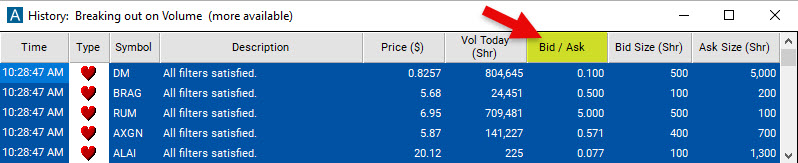

The Bid/Ask Ratio Filter is a tool used in stock trading to analyze the relationship between the bid and ask sizes of a stock. By utilizing the Bid/Ask Ratio Filter, traders can uncover market imbalances, evaluate inventory levels at the National Best Bid and Offer (NBBO), and gain insights into the relative buying and selling pressure in a given stock.

By expressing the bid and ask sizes as a ratio, rather than a fixed number, the Bid/Ask Ratio Filter enables traders to compare stocks and identify those that have an unusually high or low ratio of bid size to ask size.

By using the same filter values for different types of stocks, traders can effectively compare and analyze stocks across various sectors or market segments.

Bid-Ask-Ratio Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

To customize the Bid/Ask Ratio Filter for your scan, you can specify a desired range for the ratio, or define a minimum or maximum. Stocks with bid/ask ratios falling outside of the defined values will be excluded from the scan results.

For example, to scan for stocks with a bid/ask ratio between 0.5 and 2.0, add the Bid/Ask Ratio Filter to your scan and enter 0.5 in the minimum field and 2.0 in the maximum field in the Windows Specific Filters Tab. Adjusting these values allows you to refine your search based on the desired balance of buying and selling pressure.

Using the Bid-Ask-Ratio in Trading

Different types of traders may be interested in different bid/ask ratios depending on their trading strategies and objectives. Here are a few examples:

-

Momentum Traders/Day Traders: Momentum traders seek stocks with strong price movements and high trading volume. They may look for bid/ask ratios closer to 1 or slightly above, indicating balanced buying and selling pressure. This allows them to participate in the price momentum and capture short-term gains. The bid/ask ratio filter can be used by momentum traders to filter out stocks with illiquid markets or wide bid-ask spreads, ensuring they trade in securities with sufficient liquidity to support their trading strategies.

-

Scalpers: Scalpers aim to profit from small price fluctuations by quickly entering and exiting trades. They typically prefer stocks with tight bid/ask spreads, indicating high liquidity and low transaction costs. A bid/ask ratio close to 1 or slightly below may be suitable for scalpers, as it suggests a narrow spread and potential for quick trades.

-

Swing Traders: Swing traders hold positions for a few days to weeks, aiming to capture larger price movements. They may be interested in bid/ask ratios that show a slight dominance in either buying or selling pressure. For example, a bid/ask ratio slightly above 1 could suggest more buying interest, aligning with an upward swing.

-

Contrarian Traders: Contrarian traders take positions opposite to prevailing market sentiment. They may look for bid/ask ratios that indicate extreme imbalances, such as a significantly higher bid/ask ratio. This may indicate excessive buying or selling pressure, potentially signaling a reversal or overbought/oversold conditions.

-

Arbitrage Traders: Arbitrageurs seek to profit from price discrepancies between related securities or markets. They take advantage of temporary mispricings and execute trades to lock in risk-free profits. The bid/ask ratio filter can be useful for identifying stocks with a favorable ratio, indicating potential arbitrage opportunities where bid and ask prices are closely aligned.

FAQs about Bid-Ask-Ratio

What is the difference between the bid-ask-spread and the bid/ask ratio?

Both metrics are valuable in assessing liquidity and market conditions but provide different perspectives on the market's pricing and trading dynamics.

The bid-ask spread refers to the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask) for a particular security at a given point in time. It represents the cost of executing a trade and serves as a measure of liquidity. A narrower bid-ask spread indicates tighter liquidity, while a wider spread suggests lower liquidity. The bid-ask spread is typically expressed in terms of price.

The bid/ask ratio, on the other hand, is a metric that compares the quantity of shares or contracts available at the bid and ask prices. It is calculated by dividing the bid size (number of shares or contracts at the highest bid price) by the ask size (number of shares or contracts at the lowest ask price). The bid/ask ratio provides insights into the supply and demand dynamics of a security. A high bid/ask ratio suggests a relatively larger supply at the bid compared to the ask, while a low ratio indicates a larger supply at the ask relative to the bid.

What kind of trading strategy would benefit from a high bid/ask ratio?

A trading strategy that may benefit from a high bid/ask ratio is a market-making strategy. Market makers are traders or institutions that provide liquidity to the market by continuously quoting bid and ask prices for a particular security. They aim to profit from the bid-ask spread by buying at the bid price and selling at the ask price.

How could a trader benefit from a bid/ask ratio of 2?

A bid/ask ratio of 2 implies that there are twice as many shares being bid for compared to the number of shares being asked for at a given moment. A trader may potentially benefit from such a bid/ask ratio in several ways:

Improved Execution: A higher bid/ask ratio suggests a greater level of buying interest compared to selling interest. This increased demand may lead to quicker execution of buy orders as there are more potential sellers willing to sell at or near the current bid price. The trader may be able to buy shares at a favorable price without significantly impacting the market.

How do multiple filters and alerts work together with the Bid/Ask Ratio Filter?

When multiple filters are applied in a scan, they work as "ANDs" meaning that all the filters need to be satisfied by a stock for it to be included in the scan results.

When multiple alerts are used in a scan, they work as "ORs" indicating that only one of the alerts, along with satisfying all the filters, needs to be met for a stock to appear in the scan results.

Do you have step-by-step tutorials on how to build scans?

Please watch the following three short videos on how to create Alert and Top List Windows Scans in Trade Ideas:

Filter Info for Bid / Ask Ratio [BAR]

- description = Bid / Ask Ratio

- keywords = Bid and Ask

- units = Ratio

- format = 3

- toplistable =

- parent_code =