60 Minute Stochastic Crossed Below 80

Table of Contents

- Understanding the 60 Minute Stochastic Crossed Below 80 Alert

- Stochastic Indicator Formula

- Default Settings

- Description Column

Understanding the 60 Minute Stochastic Crossed Below 80 Alert

These alerts track the stochastics for a stock on a 5, 15, or 60 minute chart. If the stochastics say that the a stock is overbought, the server reports an alert as soon as the stock is no longer overbought. If the stochastics say that the a stock is oversold, the server reports an alert as soon as the stock is no longer over sold.

The formula watches the 80 and 20 lines to determine overbought and oversold. It reports as soon as the %D for the fast stochastic or the %K for the slow stochastic crosses the line. We use our own proprietary analytics to filter out noise when the stochastic is hovering near a line, constantly crossing back and forth.

Here's how traders interpret and use the "Stochastic Crossed Below" alert:

Bearish Momentum Signal:

- The alert is considered a bearish signal, suggesting that the recent upward momentum is weakening as the fast %K line crosses below the slower %D line. This could indicate a potential shift towards a downtrend.

Identification of Overbought Reversals:

- Traders often use the Stochastic Oscillator to identify overbought conditions, typically when %K is above 80. The "Stochastic Crossed Below" alert is particularly relevant when this crossing occurs from overbought conditions, signaling a potential reversal.

Potential Selling Opportunity:

- Traders may interpret this signal as a potential opportunity to sell or exit long positions. It indicates that the upward momentum may be losing strength, and there could be a shift in favor of downward price movement.

Confirmation and Caution:

- Traders may seek additional confirmation from other technical indicators or chart patterns to validate the potential reversal indicated by the "Stochastic Crossed Below" alert. Caution is advised, as false signals can occur, and market conditions should be carefully considered.

Adaptability to Different Timeframes:

- The "Stochastic Crossed Below" alert is applicable across various timeframes, allowing traders to use it for both short-term and long-term trading strategies.

This alert is signaled by an individual print. We do not wait for the end of the candle to report it. This means that we report the condition sooner. It also means that a historical chart might not always match the alerts.

Stochastic Indicator Formula

The most common setting for the stochastic oscillator involves using a 14-period lookback or calculation period.

The formula for the stochastic oscillator involves the following steps:

-

Calculate the closing price's highest high and lowest low over the specified period (e.g., 14 periods).

-

Use these values to calculate the %K line, representing the current closing price's position relative to the range.

-

Apply a moving average (typically a 3-period simple moving average) to smooth the %K line and generate the %D line.

The 14-period setting is considered a standard default, but traders may adjust it based on their preferences or the specific market conditions they are analyzing. Some traders may use shorter or longer periods depending on their trading strategy and the timeframe of their analysis. It's essential to consider the specific goals and characteristics of your trading strategy when choosing the period for the stochastic oscillator.

Default Settings

By default, this alert is triggered when the fast %K line of the Stochastic Oscillator crosses below the value of 80 on a 60-minute chart. To align with each alert, it's essential to utilize the corresponding time frame on the chart. For instance, this alert is visualized on the 60-minute candlestick chart.

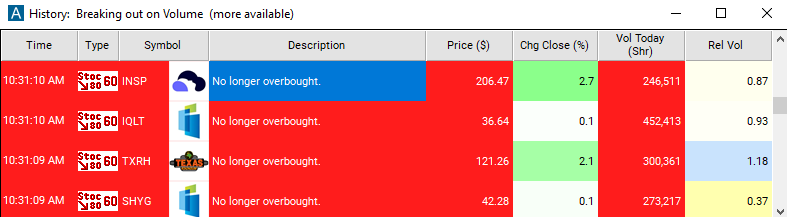

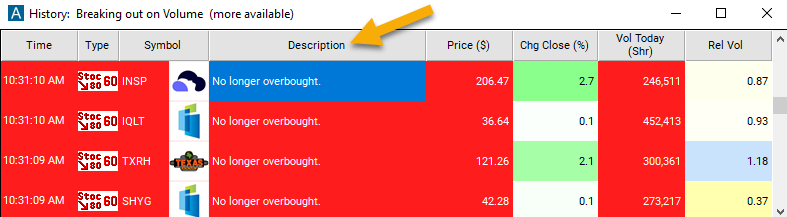

Description Column

The description column of this scan will display "No Longer Overbought", providing you with a clear indication of the specific alert that has been triggered.

Alert Info for 60 Minute Stochastic Crossed Below 80 [SC80_60]

- description = 60 minute stochastic crossed below 80

- direction = -

- keywords = Single Print Fixed Time Frame

- flip_code =

60 minute stochastic crossed above 20 [SC20_60]

60 minute stochastic crossed above 20 [SC20_60] - parent_code = SC20_5