Gap Up Reversal

Table of Contents

- Understanding the Gap Up Reversal Alert

- Default Settings

- Custom Settings

- Description Column

- Quality Column

Understanding the Gap Up Reversal Alert

A gap is when a stock changes price between yesterday's close and today's open. A gap reversal is when a stock moves in one direction between yesterday's close and today's open, then moves in the other direction after today's open. A gap reversal alert occurs when a stock price crosses yesterday's closing price for the first time since today's open.

This alert reports the size of the gap. The gap is defined as today's opening price minus yesterday's closing price. It is called a "gap up" if the stock price moves up between the close and the open. If the close and the open have the same price, there is no gap, and this alert will not occur. Note: This is a very common definition of "gap", but this is not the only definition of gap. This alert also reports the continuation. If the stock gaps in one direction, then immediately starts trading in the other direction, there is no continuation. However, if the stock gaps in one direction, then continues to trade in that direction before eventually reversing, that is called a continuation. The size of the continuation is the amount that the stock moved in the direction of the gap, after the open, but before the reversal. This alert will occur the instant a stock price crosses yesterday's close, even by a fraction of a penny. Normally this alert will not occur more than once per day. It is possible to see this more often if the exchange reports a correction to a bad print.

Default Settings

By default, the gap up reversal alert will appear when a stock price crosses yesterday's closing price from above for the first time since today's open.

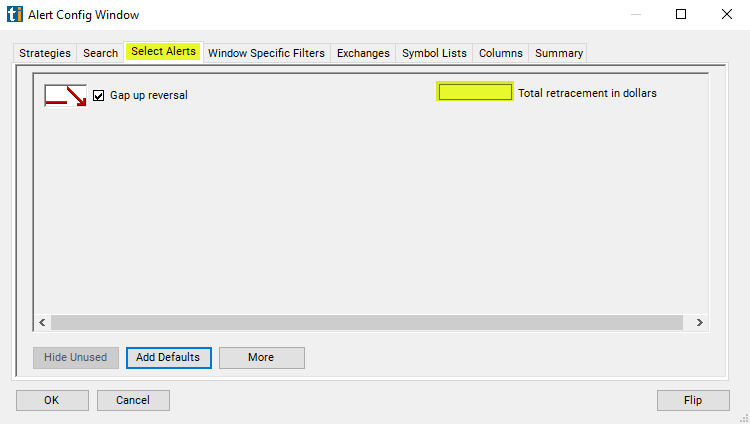

Custom Settings

For 'Gap Up Reversal' alerts, you have the option to use an alert specific filter. This filter is located immediately to the right of the corresponding alert and is always optional. You can decide to leave it blank if you want to receive more alerts, or you can fill it in to restrict the number of alerts you receive. This filter allows you to specify the quality of the alert. When you set a higher number for this filter, you are telling the alerts server to display only alerts that meet a higher quality standard, resulting in fewer alerts being shown.

When setting an alert for 'Gap Up Reversal', the user can filter gap reversals based on the maximum distance that the price moved away from the close. This value is called the total retracement. The user can specify a minimum value for the total retracement and will not see alerts with a smaller total retracement. For example, assume a stock closes at $10.00. Assume the stock opens at 10.75. Assume the stock trades up as high as 10.85. Then the price drops to 9.99. In this case the gap would be $0.75, the gap continuation would be 0.10, and the total retracement would be 0.85. The default for this value is 0. Any time a stock opens at a different price than the previous close, that stock might create a gap reversal alerts. The difference between the open and the close can be less than $0.01.

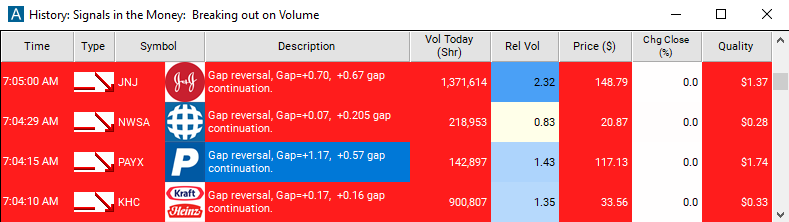

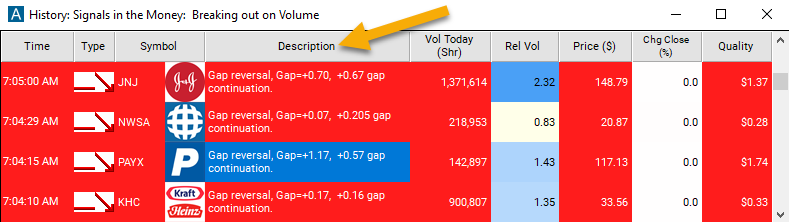

Description Column

The description of the alert will report the size of the gap and the gap continuation.

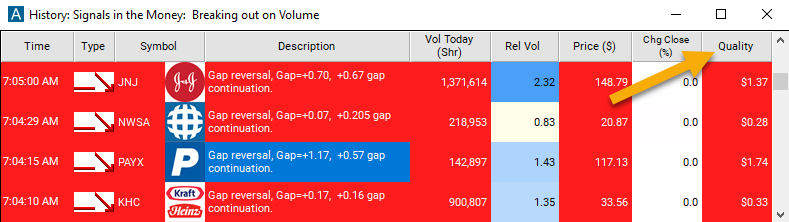

Quality Column

Add the quality column to a scan using the 'Gap Up Reversal' alert to see the sum of the gap and the gap continuation.

Alert Info for Gap Up Reversal [GUR]

- description = Gap up reversal

- direction = -

- keywords = Single Print

- flip_code =

Gap down reversal [GDR]

Gap down reversal [GDR] - parent_code = GDR