False Gap Up Retracement

Table of Contents

- Understanding the False Gap Up Retracement Alert

- Default Settings

- Custom Settings

- Description Column

- Quality Column

Understanding the False Gap Up Retracement Alert

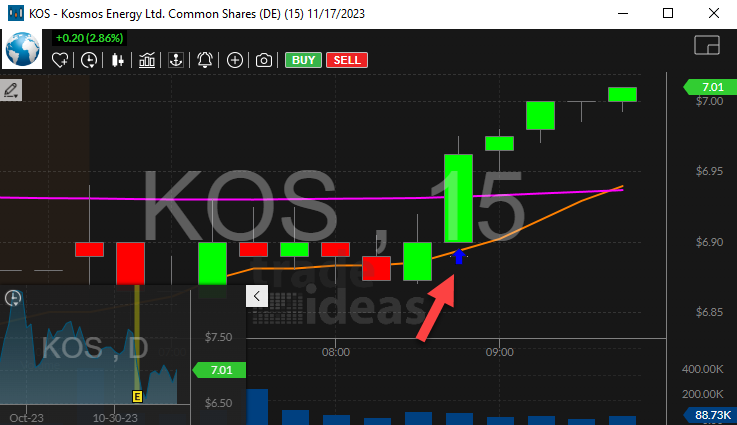

This alert occurs when a stock gaps up, starts to fill the gap, but retraces its steps and continues in the original direction of the gap.

A false gap up retracement alert occurs when the price continues above the open by a sufficient margin for the first time. In order to have an alert, there must have been a sufficiently large gap between the close and the open, and the price must have partially filled that gap. If the price immediately moves away from the close price (continuing in the direction of the gap), if the price crosses the close price (overfilling the gap), or if the gap was too small, there can be no alert.

Normally each stock can have no more than one of these alerts per day. However, if the exchange reports a correction to a bad print, it is possible to see more.

Default Settings

By default, the false gap up retracement alert occurs when the price continues above the open by a sufficient margin for the first time.

Custom Settings

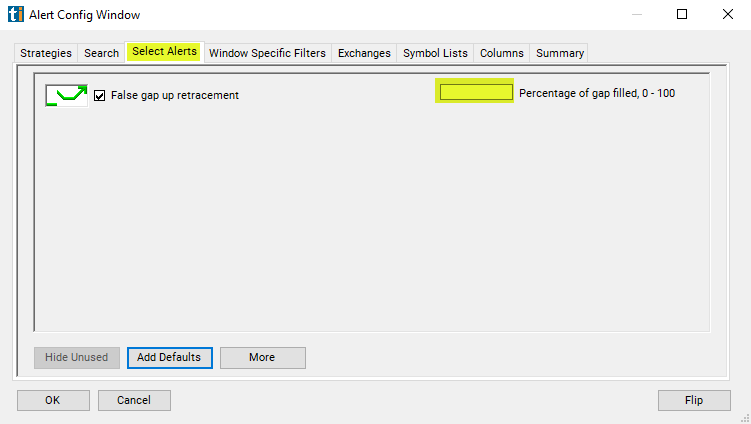

For 'False Gap Up Retracement' alerts, you have the option to use an alert specific filter. This filter is located immediately to the right of the corresponding alert and is always optional. You can decide to leave it blank if you want to receive more alerts, or you can fill it in to restrict the number of alerts you receive. This filter allows you to specify the quality of the alert. When you set a higher number for this filter, you are telling the alerts server to display only alerts that meet a higher quality standard, resulting in fewer alerts being shown.

When setting an alert for 'False Gap Up Retracement', the user can filter the alerts by the percentage of the gap which was filled.

For example, assume a stock closes at $10, then opens the next day at $11. It gapped up $1.00. Assume, as soon as it opens, the price drops. Eventually the price goes down as low as $10.40. Then the price goes back up to $11.05, to cause a False gap up retracement alert. The price went down $0.60 and the gap was $1.00, so the gap was 60% filled. If the user set this filter to 60 or less, he will see the alert. If he set this filter to a higher value, he will not see the alert.

Note: The minimum gap size and the threshold for continuing the gap are automatically determined by the alerts server. These values are different for each stock, and are chosen to avoid reporting noise. The alert describes a horseshoe shape, as shown in the icon. This setting allows the user to set the minimum height of the horseshoe.

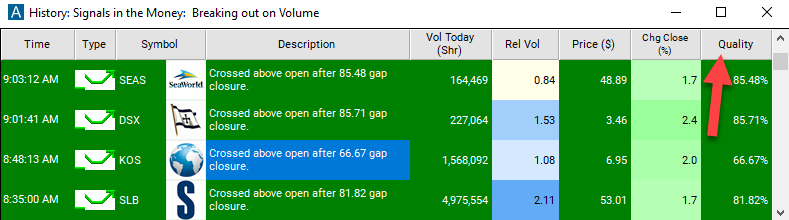

Description Column

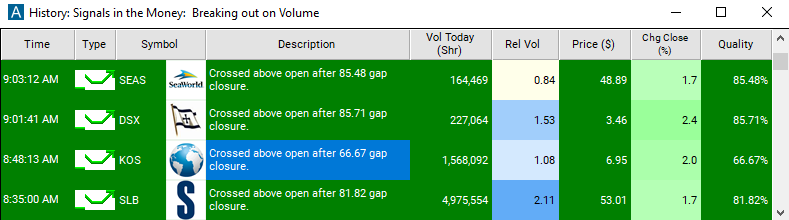

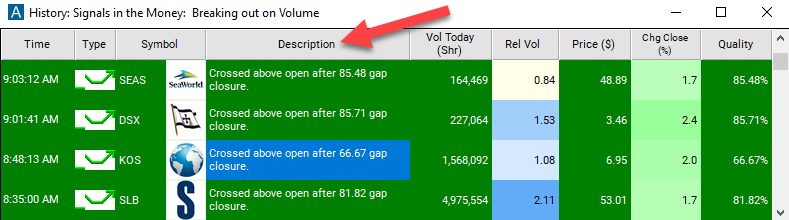

The description of the alert will report the percentage of the gap which was filled.

Quality Column

Add the quality column to a scan using the 'False Gap Up Retracement' alert to see the percentage of gap closure.

Alert Info for False Gap Up Retracement [FGUR]

- description = False gap up retracement

- direction = +

- keywords = Single Print

- flip_code =

False gap down retracement [FGDR]

False gap down retracement [FGDR] - parent_code =