Traders’ Tips

December Issue

“It’s not the strongest of the species [think traders] that survive, nor the most intelligent, but the ones most responsive to change.” Charles Darwin

For this month’s Traders’ Tips, we’ve provided a strategy that came from our support forum and learned that by changing the original intent to go long and instead short sell each opportunity, we turned a dismal strategy into a profitable one that the market’s been rewarding for awhile. The strategy is based of course on the Trade-Ideas inventory of alerts and filters and backtested with trading rules modeled in The OddsMaker.

Here is the strategy:

The strategy is just this simple: Find stocks with prices that are rising faster than the market and go long on those, and find stocks that are falling faster than the market and short those. That part is really easy. The hard part is not overstaying your welcome and getting out before these trends reverse. [Therefore] when any long stock no longer trades above its 50-day moving average, I'll sell it.

Source: email

support question based on an online article by Jim Van Meerten,

MSN Money: http://articles.moneycentral.msn.com/Investing/StrategyLab/Rnd18/P2/Strategy.aspx

Provided by:

Trade Ideas (copyright © Trade Ideas LLC 2008). All rights reserved. This sample Trade Ideas strategy is for educational purposes only and may be modified to further reflect a trading plan. Remember these are sketches meant to give an idea how to model a trading plan. Use this 'as is' or modify it as many others do. Know, however, that Trade-Ideas.com and all individuals affiliated with this site assume no responsibilities for trading and investment results.

Description: “SHORT - Rising Faster Than Market Above 50 Day SMA”

Copy this string directly into Trade-Ideas PRO using the “Collaborate” feature (right-click in any strategy window)(spaces represent an underscore if typing): http://www.trade-ideas.com/View.php?O=20000000000000000000000_1D_0&QRUI=2&MaxDNbbo=0.1&MaxSpread=10&MinDia15=0.1&MinMA50R=1&MinPUp15=0.2&MinPrice=5&MinQqqq15=0.1&MinSpy15=0.1&MinVol=500000&MinVol15=200&WN=SHORT+-+Rising+Faster+Than+Mkt+Above+50+Day+SMA+-+Hold+120m+-+Start+30+After+Open+End+30+B4+-+SL+0.75+-+Exit+on+50+SMA+Cross+

This strategy also appears on the Trade Ideas Blog: http://marketmovers.blogspot.com/.

The strategy’s filters stipulate that all 3 major indices (NASDAQ, S&P, Dow) must be up by 0.1% over a 15 minute period. Then in order to ensure all the stocks are rising faster than the markets, candidates must be up 0.2% over the last 15 minute period. Lastly the strategy stipulates that all stocks must be 1 volatility bar above the 50 day SMA. This allows us to honor the exit strategy of leaving when the stock dips below the 50 day SMA.

Given these filtered conditions, the strategy only produces an alert if a stock in this universe starts running 200% (2 as a ratio) faster than normal.

Where 1 alert and 10 filters are used with the following specific settings:

· Running Up Intermediate: 2 (run rate ratio)

· Min Price = 5 ($)

· Max Spread = 5 (pennies)

· Min Distance from Inside Market = 0.1 (%)

· Min Daily Volume = 500,000 (shares/day)

· Min Volume 15 Minute Candle = 200 (%)

· Min Up 15 Minute Candle = 0.2 (%)

· Min NASDAQ Up 15 Minute Candle = 0.1 (%)

· Min S&P Up 15 Minute Candle = 0.1 (%)

· Min Dow Up 15 Minute Candle = 0.1 (%)

· Min Up from 50 Day SMA = 1 (Volatility Bars)

The definitions of these filters appear here: http://www.trade-ideas.com/Help.html.

The problem with this strategy is that right now, the market is

not rewarding the signal to go long – it’s actually rewarding the signal as a

short opportunity. The OddsMaker summary

provides the evidence.

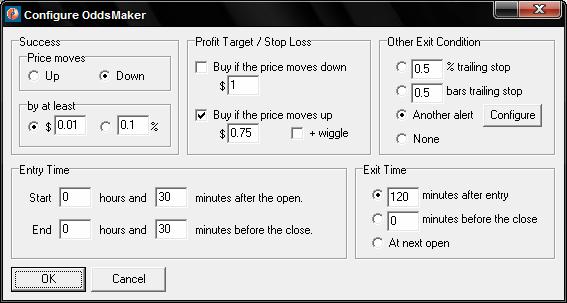

Here is what the OddsMaker said given the following trade rules:

- On each alert, sell

short

- Buy back the stock if

price moves up $0.75

- Exit if the stock

crosses the 50 day MA

- Otherwise hold the

stocks for no more than 120 minutes

- Start trading only

after the 1st 30 minutes of the session

- Stop new trades 30

minutes before the end of the session

Figure 2: The OddsMaker backtesting

configuration for ‘SHORT - Rising Faster Than Market Above 50 Day SMA’