Volume 5 Minute

Table of Contents

- Understanding the Volume 5 Minute Percent Filter

- Volume 5 Minute Percent Filter Settings

- Using Volume 5 Minute Percent in Trading

- FAQs about Volume 5 Minute Percent

Understanding the Volume 5 Minute Percent Filter

The Volume 5 Minute Percent Filter shows how the last 5 minute's trading volume compares to the expected volume for a five minute period based on the average trading volume over the last 10 days. The result is a percentage.

A percentage of 100% would indicate that the volume of shares traded aligns exactly with what would be expected given the average daily volume. Any percentage over 100% indicates that trading volume is higher than expected for the last 5-Minute period.

For instance, if you get a result of 400%, that means the stock has been trading at 4 times its average five minute volume over the last minute. Conversely, if you get a result of 50%, that means the stock has only been trading at half of its average five minute volume.

The Volume 5 Minute Percent Filter works before and after regular market hours. You should, however, adjust the thresholds for pre- and postmarket scanning, since stocks typically trade significantly less during these hours.

The formula for this filter is as follows:

((Volume 5 Minute in Shares/Average Daily Volume over the last 10 days) *78) *100

78 represents the number of five minute periods in a 6.5-hour trading day.

100 turns the ratio into a percentage.

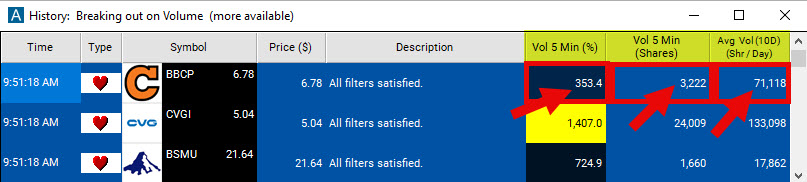

Take BBCP as an example, the Average Daily Volume over the last ten days of this stock was 71,118 shares and the Volume 5 Minute in Shares was 3,222. Applying the above formula BBCP's Volume 5 Minute in % would be calculated as follows:

((3,222/71,118)*78)*100 = 353.4%

This means that BBCP's volume of shares traded in the last five minutes represents 353.4% of the average five minute volume (over the last 10 trading days).

Volume 5 Minute Percent Filter Settings

Activating the Volume 5 Minute % Filter is straightforward. You'll find its settings under the Window Specific Filters Tab in your Alert/Top List Window's Configuration Window.

You can set a minimum and/or maximum value, and stocks that don't fit within your parameters are automatically excluded from your scan results.

-

To find stocks that have been trading at least 3 times as much as normal in the last 5 minutes, add the Volume 5 Minute Percent Filter to your scan and enter 300 in the minimum field in the Windows Specific Filters Tab.

-

To find stocks that have been trading less than normal over the last 5 minutes, add the Volume 5 Minute Percent Filter to your scan and enter 90 in the maximum field in the Windows Specific Filters Tab.

This video is showcasing the settings of the 1 Min Volume % Filter, but the exact same steps apply to this filter.

Using Volume 5 Minute Percent in Trading

The Volume 5 Minute % Filter can be a particularly effective tool for active traders, as it allows them to monitor unusual volume activity within very short time-frames. Traders can use several strategies to capitalize on this metric. Remember that these strategies are inherently short-term due to the five-minute time frame used by the filter. As with all trading strategies, the risk should be managed effectively, and individual positions should not represent a disproportionate amount of the trading capital.

Here's how you might use the Volume 5 Minute % Filter in trading:

- Breakout Strategy: Use the Volume 5 Minute Percent Filter to identify breakouts. A breakout occurs when a stock price moves above a resistance level or below a support level on significantly high volume. In this case, set your filter to a high percentage (e.g., over 300%) to locate stocks trading at a much higher than usual volume. This surge in volume can confirm the strength of the breakout.

- Volume Surge Mean Reversion: This strategy assumes that a sudden increase in volume might lead to a short-term overreaction, after which the price might revert to its mean. You can set the filter to identify stocks that have traded at an extremely high volume in the last 5 minutes (for instance, 400% or above), and then look for opportunities to trade against the resulting price move in anticipation of a reversion to the mean.

- Pre/Post-Market Trading: Use the Volume 5 Minute Percent Filter to identify stocks that are experiencing higher than average volumes in pre-market or post-market sessions. Although you should adjust the thresholds because volumes are generally lower outside regular trading hours, these anomalies could indicate a large reaction to news events or significant trader interest that could carry over into the regular session.

- Low Volume Avoidance: Conversely, you can use the filter to avoid stocks that are experiencing unusually low volume. Trading in low-volume environments can be risky due to larger spreads and more significant price impacts from trades. By setting a higher lower limit on your filter (e.g., 50% or more), you can ensure that you are only trading stocks with sufficient liquidity to enter and exit positions quickly.

- Fade Strategy: If a stock's volume is significantly lower than average (e.g., 30-50%), it could indicate a lack of interest or conviction in its current price movement. Traders can use this as an opportunity to initiate a fade strategy, which involves trading against the prevailing price trend, under the assumption that the price will move towards a direction that supports the volume.

Remember to combine this filter with other technical indicators for more robust and comprehensive trading strategies. For instance, volume can confirm signals from trend lines, moving averages, or momentum oscillators.

FAQs about Volume 5 Minute Percent

How can I see the actual number of shares a stock has traded in the last 5 minutes, or scan for stocks based on the volume they traded in the last five minutes?

This data point is available for use in custom filters. To create a custom filter showing you the number of shares a stock has traded in the last five minutes, enter the code v_up_5 in the Formula Editor.

Once created and added to your scan, this custom filter can be used just like our preset filters. You can display it as a data column in any scan, or filter stocks based on the minimum and/or maximum number of shares they have traded in the last five minutes.

How can I compare the 5 minute volume of a stock to its previous 5 minute volume in shares? In other words, I want to be notified whenever the volume of the current 5 min candle is at least twice of the volume of the previous 5 min candle.

To find stocks with increased 5-minute trading volume, you can use the formula (v_up_5/(v_up_10-v_up_5))*100 in our Formula Editor.

Here's how it works:

-

v_up_5represents the volume in shares in the last 5 minutes. -

v_up_10represents the volume in shares in the last 10 minutes. -

The expression

v_up_10 - v_up_5gives us the volume in the 5 minute period before the last 5 minutes. This is becausev_up_10includes both the last five minute and the five minutes before that, so by subtractingv_up_5(the volume in the last 5 minute), we are left with just the volume in the previous 5 minutes. -

Multiplying the resulting ratio by 100 gives us the result as a percentage.

Please note: This filter as well as most of our other alerts and filters is looking at time periods, not specific candles.

You can add it as a column to your scan to simply see the value or give it specific min/max values in the Windows Specific Filters Tab to scan for stocks with a high % difference.

As an example, to only see stocks where the last 5 Minute Volume is at least 2 times the Volume in the previous 5 minutes, add this filter to your scan and enter 200 in the minimum field of the Windows Specific Filters Tab.

Since this is a filter, you will need to combine it with a New High, 5 Minute High, Running Up or any other alert, in order to be alerted.

Does the Volume 5 Minute % Filter look at the open or close of the candle?

The calculation for the Volume 5 Minute % Filter isn't influenced by the specific components of five minute bars, such as the opening or closing points. Rather, this filter operates on a continuous time basis, assessing the trading volume in relation to exactly five minutes in the past, irrespective of the candlestick charting. This means it is continually evaluating volume changes over rolling five minute intervals, providing real-time insights beyond the static start and end points of individual candlesticks.

What could be causing extreme spikes as shown by the Volume 5 Minute Percent Filter?

Extreme spikes in the Volume 5 Minute Percent Filter often result from significant news events, earnings releases, or large trades by institutional investors. High volume can indicate strong investor interest and potential price volatility. However, it's important to look at the context: if the price is not moving significantly with high volume, it could indicate indecision in the market.

How can I incorporate the Volume 5 Minute Percent Filter into my existing trading strategy?

The Volume 5 Minute Percent Filter can be used as an additional layer of confirmation for your trading signals. For instance, if your strategy generates a buy signal, you may choose to only take the trade if the volume is above a certain threshold, suggesting strong buying interest.

How can I adjust the Volume 5 Minute Percent Filter for different market conditions?

You should remember to adjust the settings of your Volume 5 Minute Percent Filter based on different market conditions. For instance, during more volatile periods, you may wish to raise your minimum threshold to catch only the most extreme volume surges. Conversely, in quieter markets, lowering the threshold might provide more actionable signals.

How reliable is the Volume 5 Minute Percent Filter for detecting meaningful market activity?

Like any technical indicator, the Volume 5 Minute Percent Filter is not infallible and should not be used in isolation. It is most reliable when combined with other indicators and used as part of a comprehensive trading strategy. The key is to find combinations of filters and indicators that work best for your trading style and risk tolerance.

Always remember to factor in the broader market context, your overall trading strategy, and risk management principles when making trading decisions.

How can I use the Volume 5 Minute Percent Filter in short selling strategies?

For short selling strategies, you could use the Volume 5 Minute Percent Filter to identify potential overbought conditions that may precede a price drop. For instance, a very high filter value could indicate a rush of buyers, which might not be sustainable. If this surge is coupled with other indicators like an overbought RSI or a reversal candlestick pattern, it may suggest a good short selling opportunity.

How do the Volume 5 Minute % Filter and the Relative Volume Filter compare?

The Volume 5 Minute Percent Filter and the Relative Volume Filter are both useful tools for traders, and they serve slightly different purposes, so the choice between them depends on the specific needs of the trader.

Use the Volume 5 Minute Percent Filter when you want to monitor changes in trading volume on an intraday basis. It's particularly useful if you're interested in trading during premarket hours, since the Relative Volume Filter does not work in the early morning session.

On the other hand, use the Relative Volume Filter when you want a more contextual view of the trading volume, comparing the current volume to the average volume for the same time of day. This is particularly useful for identifying shifts in market sentiment that might not be immediately apparent from the raw trading volume alone.

How does the filter handle stocks with low liquidity or high volatility?

The filter calculates a percentage based on trading volume, so it will function regardless of the liquidity or volatility of a stock. However, for low-liquidity stocks, volume data may be more erratic, and high percentages may be less meaningful. For high-volatility stocks, large volume changes may occur frequently.

Are there any potential pitfalls or limitations when using the Volume 5 Minute Percent Filter?

As with any indicator, it's not foolproof. A sudden spike in volume doesn't necessarily mean a profitable trading opportunity will follow. It's essential to combine it with other indicators and techniques to confirm trading signals.

How does this filter perform in longer timeframes?

The Volume 5 Minute Percent Filter is specifically designed for a 5-minute timeframe, capturing intraday volume spikes. It may not provide meaningful information when used in longer timeframes, like daily or weekly.

Filter Info for Volume 5 Minute [Vol5]

- description = Volume 5 Minute

- keywords = Fixed Time Frame

- units = %

- format = 1

- toplistable = 1

- parent_code =

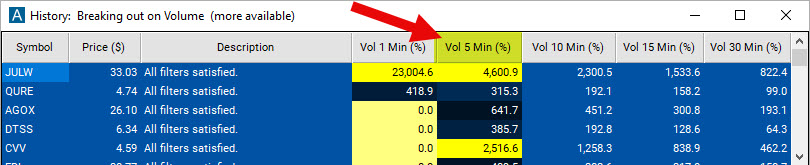

Volume 10 Minute [Vol10]

Volume 10 Minute [Vol10] Volume 15 Minute [Vol15]

Volume 15 Minute [Vol15] Volume 30 Minute [Vol30]

Volume 30 Minute [Vol30]