Enterprise Value / Market Cap Ratio

Table of Contents

- Understanding the Enterprise Value Market Cap Ratio Filter

- Enterprise Value Market Cap Ratio Filter Settings

- Using the Enterprise Value Market Cap Ratio Filter

- FAQs

Understanding the Enterprise Value Market Cap Ratio Filter

The EV-to-Market Cap ratio provides insights into the financial structure and leverage of a company. A smaller ratio suggests a stronger company with less debt relative to its equity, while a larger ratio indicates higher leverage and potentially greater financial risk.

Enterprise Value (EV):

- Enterprise value represents the total value of a company, including its equity, debt, and cash holdings. It provides a more comprehensive view of a company's worth compared to market capitalization alone.

- EV is calculated by adding a company's market capitalization (the total value of its outstanding shares) to its total debt, minority interest, and preferred shares, then subtracting its cash and cash equivalents.

Market Capitalization (Market Cap):

- Market capitalization is the total value of a company's outstanding shares of stock. It is calculated by multiplying the current share price by the total number of outstanding shares.

- Market cap provides a measure of the company's equity value as perceived by the stock market.

Enterprise Value to Market Cap Ratio:

- This ratio compares the enterprise value of a company to its market capitalization. It is calculated by dividing the enterprise value by the market cap.

- A smaller value of this ratio typically suggests that the company is stronger. This is because a lower ratio indicates that the company's market capitalization (equity value) is relatively higher compared to its enterprise value (which includes debt).

- On the other hand, a larger value of this ratio indicates that the company is more leveraged. A higher ratio implies that a significant portion of the company's total value is represented by debt rather than equity.

Enterprise Value Market Cap Ratio Filter Settings

Configuring the "Enterprise Value Market Cap Ratio" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

- Set the minimum value to 20 to see only stocks with an enterprise value to market cap ratio of at least 20/1.

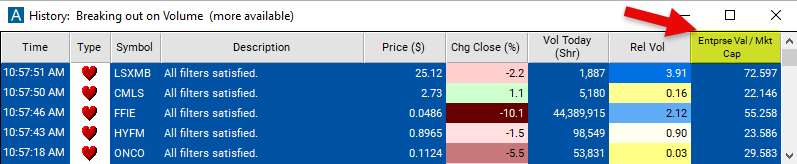

Using the Enterprise Value Market Cap Ratio Filter

The "Enterprise Value Market Cap Ratio" filter can be used in various trading strategies, including:

Contrarian Strategy: Identify companies with relatively low EV-to-Market Cap ratios compared to their industry peers. Companies with low ratios may be undervalued, indicating potential buying opportunities. Conduct thorough fundamental analysis to ensure there are no underlying issues causing the undervaluation.

Pairs Trading: Identify pairs of companies within the same industry or sector. Compare their EV-to-Market Cap ratios to find discrepancies. Take long positions in companies with relatively low ratios and short positions in companies with relatively high ratios, assuming the ratios will converge.

Event-Driven Strategy: Monitor corporate events such as mergers, acquisitions, or divestitures. Evaluate the impact of these events on a company's EV-to-Market Cap ratio. Take positions based on expectations of how the event will affect the ratio and stock prices.

FAQs

What does a high EV-to-Market Cap ratio indicate?

- A high ratio suggests that a significant portion of the company's total value is represented by debt rather than equity. It may indicate that the company is highly leveraged and potentially risky.

What does a low EV-to-Market Cap ratio indicate?

- A low ratio may suggest that the company's equity value is relatively higher compared to its total value, including debt. It could indicate potential undervaluation or a strong financial position.

How can changes in the EV-to-Market Cap ratio affect investment decisions?

- Significant changes in the ratio may signal shifts in a company's financial health or market sentiment. Investors should investigate the reasons behind such changes before making investment decisions.

Is there a "normal" range for the EV-to-Market Cap ratio?

- The "normal" range can vary widely depending on factors such as industry dynamics, company size, and market conditions. Investors should compare a company's ratio to its peers within the same industry for better context.

Filter Info for Enterprise Value / Market Cap Ratio [ValueMCap]

- description = Enterprise Value / Market Cap Ratio

- keywords = Fundamentals Changes Daily

- units = Ratio

- format = 3

- toplistable = 1

- parent_code =