Enterprise Value

Table of Contents

- Understanding the Enterprise Value Filter

- Enterprise Value Filter Settings

- Using the Enterprise Value Filter

- FAQs

Understanding the Enterprise Value Filter

Enterprise Value (EV) is a comprehensive measure to assess the theoretical takeover price of a company. It provides a holistic view of a company's total value, taking into account both its equity and debt components. The formula for calculating Enterprise Value is as follows:

Enterprise Value = Market Cap + Total Debt − Total Cash & Short-Term Investments

Let's break down each component of the formula:

Market Cap: Market Capitalization, often referred to as "Market Cap," represents the total market value of a company's outstanding shares of common stock. It is calculated by multiplying the current market price of a company's stock by the total number of outstanding shares. Market Cap reflects the equity value of the company and represents the total value that equity investors attribute to the business.

Total Debt: Total Debt refers to the aggregate amount of all outstanding debt obligations owed by a company, including long-term debt, short-term debt, and any other forms of debt financing. It encompasses borrowings from creditors, bondholders, and financial institutions. Total Debt represents the company's obligations to repay borrowed funds and reflects the leverage or indebtedness of the company.

Total Cash: Total Cash represents the combined amount of cash and cash equivalents held by a company, including cash in bank accounts, marketable securities, and other liquid assets readily available for use. Cash equivalents typically include short-term investments with high liquidity and low risk of value fluctuations. Total Cash reflects the company's financial liquidity and ability to meet its short-term obligations.

Short-Term Investments: Short-Term Investments refer to investments held by a company that are expected to be converted into cash or sold within a relatively short period, typically less than one year. These investments may include marketable securities, certificates of deposit (CDs), treasury bills, and other highly liquid investments. Short-Term Investments enhance the company's liquidity and may generate additional income.

Enterprise Value Filter Settings

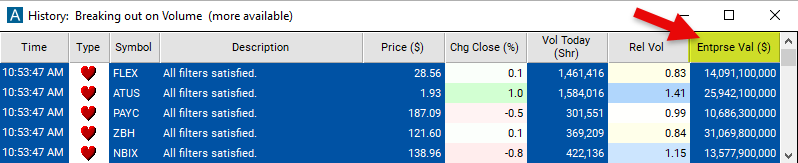

Configuring the "Enterprise Value" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

- Set the minimum value to 10,000,000,000 to see only stocks with an enterprise value of at least $10 billion.

Using the Enterprise Value Filter

The "Enterprise Value" filter can be used in various trading strategies, including:

Value Investing: Value investing strategies involve identifying stocks that are trading at a discount to their intrinsic value, as indicated by their Enterprise Value relative to their market price. Traders may seek stocks with low EV-to-EBITDA (Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization) ratios or low EV-to-revenue ratios compared to industry peers. By targeting undervalued stocks with attractive EV metrics, traders aim to capitalize on potential price appreciation as the market recognizes the stocks' true worth.

Pairs Trading: Pairs trading strategies involve simultaneously buying and selling two correlated stocks based on their relative Enterprise Values. Traders may identify pairs of stocks within the same industry or sector with diverging Enterprise Value multiples, such as EV-to-EBITDA or EV-to-revenue ratios. By taking long and short positions in these pairs, traders aim to profit from the convergence or divergence of Enterprise Value multiples between the two stocks.

Sector Rotation: Sector rotation strategies involve rotating investments among different sectors based on Enterprise Value metrics and sector valuation dynamics. Traders may allocate capital to sectors or industries with low EV multiples relative to historical averages or sector benchmarks, indicating potential value opportunities. Conversely, traders may reduce exposure to sectors with high EV multiples, anticipating potential overvaluation or downside risk.

FAQs

What is Enterprise Value, and why is it important?

- Enterprise Value represents the theoretical takeover price of a company and provides a comprehensive measure of its total value, taking into account both equity and debt components. It is important because it offers a more complete picture of a company's valuation than market capitalization alone, incorporating debt levels and cash balances into the assessment.

What does a high or low Enterprise Value indicate?

- A high Enterprise Value relative to a company's market capitalization may indicate that the company has significant debt obligations or low levels of cash and short-term investments, potentially making it less attractive to investors. Conversely, a low Enterprise Value relative to market capitalization may suggest that the company is undervalued, presenting potential investment opportunities.

How does Enterprise Value differ from market capitalization?

- Market capitalization represents the total market value of a company's outstanding shares of common stock, whereas Enterprise Value takes into account both equity and debt components of a company's capital structure. While market capitalization reflects the value that equity investors attribute to the business, Enterprise Value provides a more comprehensive measure of the company's total value, including its debt obligations and financial resources.

How is Enterprise Value used in stock trading?

- Enterprise Value is used in stock trading to assess a company's valuation, identify investment opportunities, and compare companies within the same industry or sector. Traders may use Enterprise Value multiples, such as EV/EBITDA or EV/revenue, to evaluate relative valuation and make informed trading decisions.

Filter Info for Enterprise Value [Value]

- description = Enterprise Value

- keywords = Fundamentals Changes Daily

- units = $

- format = 0

- toplistable = 1

- parent_code =