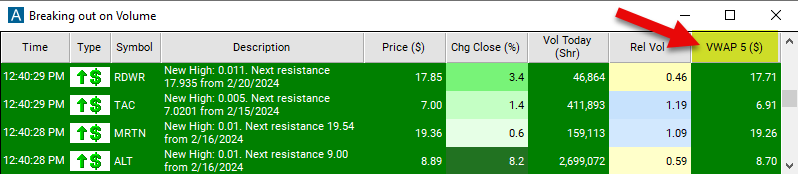

VWAP 5

Table of Contents

Understanding the VWAP 5 Filter

Our VWAP 1, 2, 3, 4 and 5 filters provide the 5 anchored VWAP values in dollars.

The VWAP 5 filter refers to the Volume Weighted Average Price calculated over a specific period. In this case, over the last trading week. VWAP is a trading benchmark that gives the average price a stock has traded at throughout the trading day, weighted by volume.

Here's how the VWAP 5 filter works:

Calculation of VWAP: VWAP is calculated by multiplying the price of each trade by the volume of that trade, summing up these values, and dividing the total by the cumulative volume traded over the period. In the case of VWAP 5, it represents the VWAP over the last trading week.

Application in Trading: Traders use VWAP 5 as a reference point to assess the average price levels at which significant trading activity has occurred over the last 5 trading days.

Intraday Analysis: While VWAP is typically calculated throughout the trading day, VWAP 5 provides a longer-term perspective on the average price weighted by volume over the last 5 trading days. Traders can monitor VWAP 5 throughout the current trading day to gauge price levels relative to this longer-term average.

VWAP 5 Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here is how to setup the filter in your configuration window:

- Set the min value to $5 and the max value to $20 to filter for stocks with a VWAP within the range of $5 to $20 over the past trading week.

Using the VWAP 5 Filter

Several trading strategies can be employed with the VWAP 5 filter. Here are a few examples:

Breakout Trading: Breakout traders can use the VWAP 5 filter to identify breakout opportunities. If the current price breaks out above or below the VWAP 5 level with significant volume, it may signal the beginning of a new trend. Traders can enter long positions on bullish breakouts above the VWAP 5 and short positions on bearish breakouts below it.

Pullback Trading: Pullback traders may use the VWAP 5 filter to identify potential pullback opportunities within the trend. If the price retraces towards the VWAP 5 after a strong move in the trend direction, it may offer a favorable entry point. Traders can enter positions on pullbacks, anticipating the resumption of the prevailing trend.

Scalping: Short-term traders can use the VWAP 5 filter to scalp intraday price movements. By entering and exiting positions quickly based on deviations from the VWAP 5, traders can capture short-term profits from rapid price fluctuations within the trading session.

FAQs

What is VWAP, and how is the VWAP 5 filter calculated?

- VWAP is a trading indicator that represents the average price a security has traded at throughout the day, weighted by volume. The VWAP 5 filter calculates the VWAP over the past five trading days for each stock. It is calculated by multiplying the price of each trade by the volume traded and dividing the sum by the total volume traded over this five-day period.

What does it mean if a stock's current price is above or below the VWAP 5?

- If a stock's current price is above the VWAP 5, it indicates that the stock's current price is trading above the average price it has traded at over the past five days. Conversely, if the current price is below the VWAP 5, it indicates that the stock's price is trading below the five-day average.

How can traders use the VWAP 5 filter in their trading strategies?

- Traders can use the VWAP 5 filter in various trading strategies, such as trend confirmation, mean reversion, breakout trading, volume confirmation, pullback trading, and scalping. By analyzing stocks' positions relative to the VWAP 5, traders can identify potential entry or exit points and make informed trading decisions.

Filter Info for VWAP 5 [VWAP5]

- description = VWAP 5

- keywords = Single Print

- units = $

- format = p

- toplistable = 1

- parent_code =