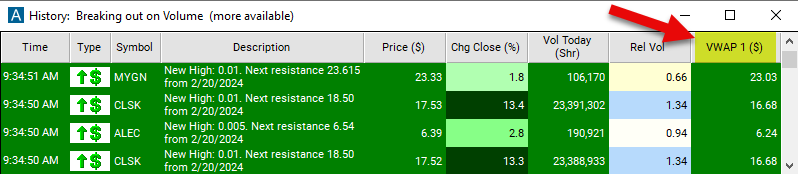

VWAP 1

Table of Contents

Understanding the VWAP 1 Filter

Our VWAP 1, 2, 3, 4 and 5 filters provide the 5 anchored VWAP values in dollars.

The VWAP 1 filter refers to the Volume Weighted Average Price calculated over a specific period. In this case, starting at todays open. VWAP is a trading benchmark that gives the average price a stock has traded at throughout the trading day, weighted by volume.

Here's how the VWAP 1 filter works:

Calculation of VWAP: VWAP is calculated by multiplying the price of each trade by the volume of that trade, summing up these values, and dividing the total by the cumulative volume traded over the period. In the case of VWAP 1, it represents the VWAP over the last trading day.

Application in Trading: Traders use VWAP 1 as a reference point to assess the average price levels at which significant trading activity has occurred during the trading day.

Intraday Analysis: VWAP is typically calculated throughout the trading day, updating continuously as new trades occur. Traders can monitor VWAP 1 throughout the day to gauge the price levels relative to the average price, providing insights into market sentiment and potential trading opportunities.

VWAP 1 Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here is how to setup the filter in your configuration window:

-

Set the min value to $5 to see stocks with a VWAP value currently over $5.

-

Set the max value to $5 to see stocks with a VWAP value currently under $5.

Using the VWAP 1 Filter

Several trading strategies can be employed with the VWAP 1 filter. Here are a few examples:

Mean Reversion Strategy: Traders anticipate that the price will revert to the mean represented by VWAP 1 after a significant deviation. When the current price deviates significantly below VWAP 1, indicating oversold conditions, traders may consider buying opportunities, anticipating a bounce back towards VWAP. Conversely, when the price deviates significantly above VWAP 1, indicating overbought conditions, traders may consider selling opportunities, anticipating a pullback towards VWAP.

Breakout Strategy: Traders look for breakout opportunities when the price moves significantly above or below VWAP 1. If the price breaks out above VWAP 1 with significant volume, it may indicate a bullish breakout. Traders can buy the stock with the expectation of further upward movement. Conversely, if the price breaks out below VWAP 1 with significant volume, it may indicate a bearish breakout. Traders may consider short-selling the stock.

Trend Confirmation Strategy: Traders use VWAP 1 to confirm the direction of the trend. In an uptrend, if the price consistently remains above VWAP 1, it confirms the bullish sentiment, and traders may consider buying opportunities. Conversely, in a downtrend, if the price consistently stays below VWAP 1, it confirms the bearish sentiment, and traders may consider short-selling opportunities.

FAQs

What does VWAP 1 stand for, and how is it calculated?

- VWAP 1 represents the Volume Weighted Average Price calculated over the last trading day. It is calculated by multiplying the price of each trade by the volume of that trade, summing up these values, and dividing the total by the cumulative volume traded over the period.

What is the significance of VWAP 1 in trading?

- VWAP 1 is an important benchmark used by traders to assess the average price at which a stock has traded during the previous trading day, weighted by volume. It helps traders gauge the fairness of the current price and identify potential trading opportunities.

How frequently should I refer to VWAP during the trading day?

- The frequency of referring to VWAP depends on your trading style and objectives. Some traders monitor VWAP continuously throughout the trading day, while others may only check it periodically, such as at the open, close, or during key market events. It's essential to find a balance that suits your trading strategy and objectives.

Filter Info for VWAP 1 [VWAP1]

- description = VWAP 1

- keywords = Single Print

- units = $

- format = p

- toplistable = 1

- parent_code =