2 Minute RSI

Table of Contents

- Understanding the 2 Minute RSI Filter

- 2 Minute RSI Filter Settings

- Using the 2 Minute RSI Filter

- FAQs

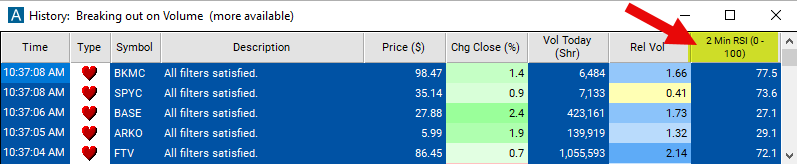

Understanding the 2 Minute RSI Filter

The 2-minute Relative Strength Index (RSI) filter is a technical analysis tool used to assess the current momentum of a stock over a short timeframe, in this case a 2-minute chart. RSI is a momentum oscillator that measures the speed and change of price movements. It oscillates between 0 and 100 and is calculated using the average gain and average loss over 14 periods.

Here's how the 2-minute RSI filter works:

Calculation: The 2-minute RSI is calculated based on the price movements of the stock over the last 2-minute period. It compares the magnitude of recent gains and losses to determine whether the stock is overbought or oversold.

Interpretation: An RSI value above 70 typically indicates that the stock is overbought, suggesting that it may be due for a pullback or reversal. Conversely, an RSI value below 30 indicates that the stock is oversold, suggesting that it may be poised for a bounce or recovery.

This filter does not use pre- or post-market data.

2 Minute RSI Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here is how to setup the filter in your configuration window:

- Set the min 2 minute RSI to 70 (overbought) and the max to 30 (oversold) to find stocks which are overbought and also to find stocks that are oversold.

Using the 2 Minute RSI Filter

Several trading strategies can be employed with the 2 Minute RSI filter. Here are a few examples:

RSI Centerline Crosses: Traders monitor RSI crosses of the centerline (50). When the 2-minute RSI crosses above 50, it suggests increasing buying pressure, and traders may consider going long. Conversely, when the RSI crosses below 50, it indicates increasing selling pressure, and traders may consider shorting or selling the stock.

RSI Trendline Breaks: Traders draw trendlines on the RSI indicator to identify breaks. When the 2-minute RSI breaks above a downtrend line or below an uptrend line, it may signal a potential reversal in price direction. Traders may take positions in anticipation of the reversal, such as entering long positions after a bullish RSI trendline break.

RSI Range Trading: Traders identify a range-bound market using RSI. In a range-bound market, traders may buy near the oversold level (RSI below 30) and sell near the overbought level (RSI above 70). They aim to profit from mean reversion as the price oscillates within the range.

FAQs

What is the 2-minute RSI and how is it calculated?

- The 2-minute RSI is a technical indicator that measures the speed and change of price movements over a 2-minute timeframe. It's calculated using the average gain and average loss over the last 2-minute period. The formula involves dividing the average gain by the average loss and converting it to an index that oscillates between 0 and 100.

How do I interpret overbought and oversold conditions on the 2-minute RSI?

- RSI levels above 70 are considered overbought, indicating that the stock may be due for a pullback or reversal. Conversely, RSI levels below 30 are considered oversold, suggesting that the stock may be poised for a bounce or recovery.

Can the 2-minute RSI be used for day trading or scalping?

- Yes, the 2-minute RSI can be used for day trading or scalping strategies, as it provides insights into short-term momentum and price fluctuations. Traders often use it to identify intraday trading opportunities and make quick decisions based on rapid price movements.

Filter Info for 2 Minute RSI [RSI2]

- description = 2 Minute RSI

- keywords = Fixed Time Frame

- units = 0 - 100

- format = 1

- toplistable = 1

- parent_code = RSI1