Options Volume Today

Table of Contents

- Understanding the Options Volume Today in Percent Filter

- Options Volume Today in Percent Filter Settings

- Using the Options Volume Today in Percent in Trading

- FAQs about Options Volume Today in Percent

Understanding the Options Volume Today in Percent Filter

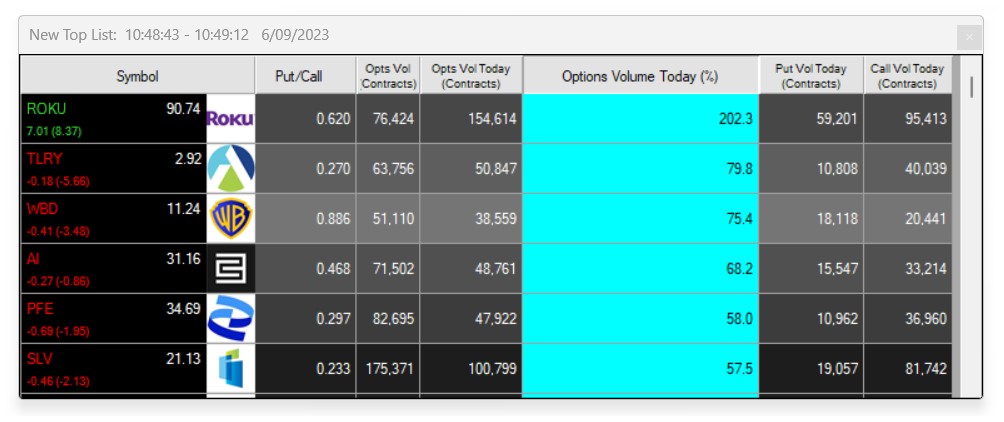

The Options Volume Today (%) Filter enables traders to determine if today's options volume for a stock is unusual or normal. This filter compares the number of contracts (puts and calls) traded today to the number of contracts the same stock usually trades in an entire day.

For example, let’s say you are looking for stocks with unusually high options volume. You set the minimum value for this filter to 200%. Then you will only see stocks which have already traded twice as many options today as they trade on a normal day.

Options Volume Today in Percent Filter Settings

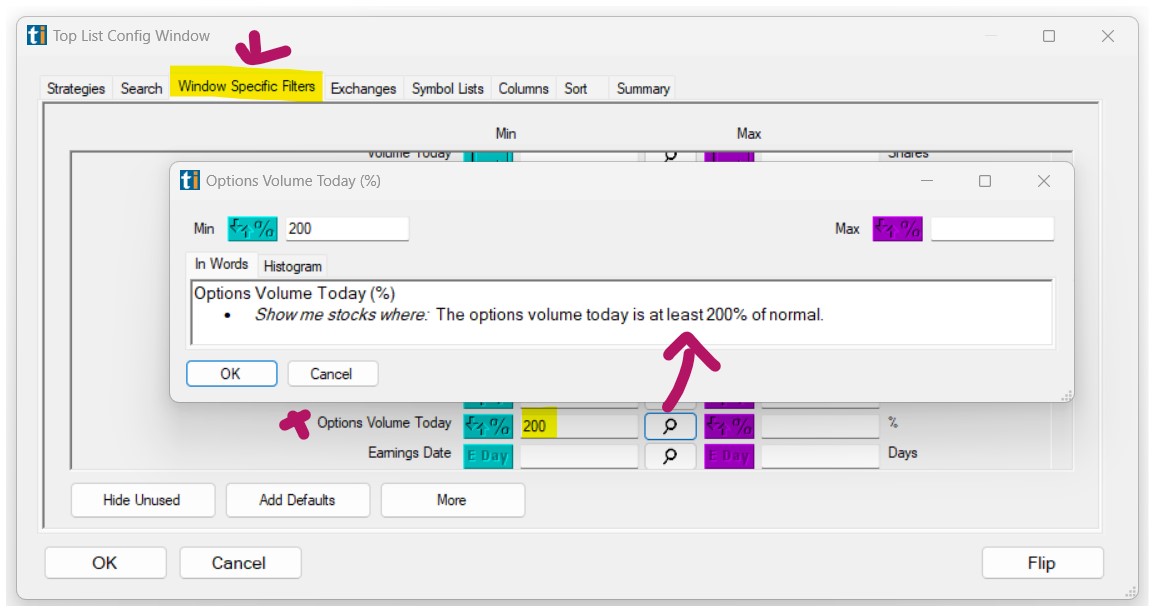

Activating the Options Volume Today % Filter is straightforward. You'll find its settings under the Window Specific Filters Tab in your Alert/Top List Window's Configuration Window.

You can set a minimum and/or maximum value, and stocks that don't fit within your parameters are automatically excluded from your scan results.

-

To find stocks that have a 200% higher than usual options activity, add the Options Volume Today % Filter to your scan and enter 200 in the minimum field in the Windows Specific Filters Tab.

-

To find stocks that show 50% or lower options volume than on an average day, add the Options Volume Today % Filter to your scan and enter 50 in the maximum field in the Windows Specific Filters Tab.

-

To find stocks that today show an unusually high options volume between 300% and 700%, add the Options Volume Filter to your scan and enter 300 in the minimum field and 700 in the maximum field in the Windows Specific Filters Tab.

Using the Options Volume Today in Percent in Trading

Before we dive into specific strategies, it's crucial to understand the significance of options volume. High volume indicates significant trader interest in the stock, which can lead to increased price volatility. On the other hand, low volume suggests that the stock isn’t garnering much attention.

Anomalies in options volume - especially sudden spikes - can be predictive or indicative of forthcoming events or sentiment shifts. It might indicate insider knowledge, earnings predictions, pending news, or large institutional trading behaviors.

The Options Volume Today in Percent Filter is an excellent tool for traders looking to capitalize on unusual trading activity or those wanting to adopt a more conservative approach by avoiding volatile stocks. By understanding and strategically applying this filter, traders can find unique opportunities that might otherwise go unnoticed.

Here are some strategies to apply using the Filter:

-

Trading on Unusual Volume: If a stock displays an increase in options trading volume compared to its average, it might be an indication that something significant is about to happen or is already in progress. For instance, merger and acquisition rumors, FDA announcements for pharmaceuticals, or upcoming earnings reports can be triggers.

-

Defensive Filtering: Perhaps you want to avoid stocks that are currently facing high volatility or speculative trading. Setting the filter to show stocks with no more than 100% options volume allows you to exclude these stocks from your watchlist, ensuring a more conservative approach.

-

Trading on Low Volume: Unusually low options volume might indicate a lack of interest from traders, potentially signaling that the stock is undervalued or overlooked.

Remember: While the Options Volume Today in Percent Filter is a powerful tool, it should not be the sole basis of any trading decision. Other factors, such as fundamental analysis, other technical indicators, and current market news, should also be considered.

FAQs about Options Volume Today in Percent

Why might there be spikes in options volume for certain stocks?

Spikes in options volume can result from several events. It might be due to impending corporate announcements, mergers, acquisitions, FDA approvals for pharmaceutical companies, expected earnings results, or large institutional trades. Sometimes, it can also indicate potential insider trading or market manipulation.

Are there any risks associated with trading stocks that show unusual options volume?

Absolutely. High options volume might indicate high interest, but it doesn't always mean a positive price movement. It could lead to increased volatility, both up or down. Always research and understand the cause of the volume spike before making any trading decisions.

Can I use this filter in conjunction with other filters or technical indicators?

Yes, and it's highly recommended. The more confluence factors you have supporting a trading decision, the stronger the signal typically is. For example, coupling high options volume with a bullish moving average crossover can increase the probability of a positive outcome.

Does high options volume always lead to a significant price move in the underlying stock?

No. While high options volume can indicate strong interest and potential for price movement, it's not a guarantee. The underlying stock price may remain unaffected or not move as much as expected.

How can I determine the cause behind an unusual options volume?

Utilize the News Tab of our Single Stock Window, financial news websites, and even social media platforms like Twitter to see if there's any buzz or recent news about the stock. Companies' investor relations pages might also have recent announcements.

Is this filter applicable for all types of trading, like day trading, swing trading, or long-term investing?

The filter can be used for any trading style but is especially useful for day and swing traders who capitalize on short-term movements and volatility. Long-term investors might use it as a precautionary tool to avoid entering a position during volatile times.

Does the Options Volume Today in Percent Filter work better with certain sectors or types of stocks?

While the filter itself is neutral to sectors, certain sectors like technology or pharmaceuticals can often have more pronounced spikes in options volume due to product launches, FDA decisions, or tech advancements. Always be attentive to sector-specific news.

Can high options volume indicate both bullish and bearish sentiments?

Yes. A spike in options volume can result from a large number of call options (bullish sentiment) or put options (bearish sentiment). To gain better insights, traders should look at the volume of calls vs. puts. Have a look at our Put/Call Ratio Filter to get a more comprehensive picture.

Can the filter be misleading if the typical daily volume for a stock is already low?

Potentially. If a stock generally has low options volume, a slight increase can result in a high percentage change, even if the absolute number of contracts isn't significant. Always look at the raw numbers in conjunction with percentages. Use our additional option filters, like the Options Volume Today % Filter, the Put Volume Today Filter, the Call Volume Today Filter and the Put/Call Ratio Filter to get further insights.

Should I be cautious of using this filter during major economic announcements?

Yes. Major economic events can cause increased volatility and unusual options activity across various stocks. During such times, it's essential to interpret the data in the context of broader market conditions.

How does market liquidity impact the efficacy of this filter?

Stocks with higher liquidity tend to have smoother options volume patterns, while those with lower liquidity can see erratic changes. The filter's efficacy might be compromised for illiquid stocks, so always consider liquidity in your analysis.

Filter Info for Options Volume Today [PCPV]

- description = Options Volume Today

- keywords =

- units = %

- format = 1

- toplistable = 1

- parent_code = PCTV