Options Volume

Table of Contents

- Understanding the Options Volume Filter

- Options Volume Filter Settings

- Using the Average Options Volume in Trading

- FAQs about Options Volume

Understanding the Options Volume Filter

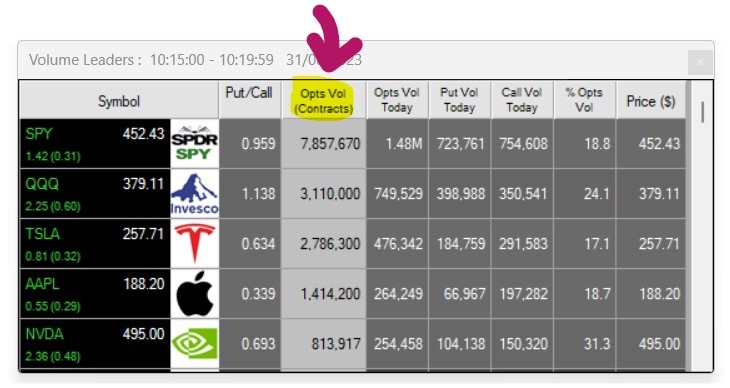

The Options Volume Filter enables traders to find stocks based on the average number of option contracts traded. This filter looks at the puts and calls traded on an average day to provide a more stable representation of options trading activity for a stock.

To scan for stocks based on the number of contracts traded today, use the Options Volume Today Filter

Stocks that are actively traded as options often exhibit high liquidity, volatility, and investor interest. Whether you're seeking high-volume opportunities, aiming to avoid extreme speculation, or searching for a balanced approach, the Options Volume Filter can provide valuable insights to refine your stock trading strategy.

Options Volume Filter Settings

Activating the Options Volume Filter is straightforward. You'll find its settings under the Window Specific Filters Tab in your Alert/Top List Window's Configuration Window.

You can set a minimum and/or maximum value, and stocks that don't fit within your parameters are automatically excluded from your scan results.

-

To find stocks that are trading at least 10,000 contracts on an average day, add the Options Volume Filter to your scan and enter 10000 in the minimum field in the Windows Specific Filters Tab.

-

To find stocks that are trading no more than 1 Million puts and calls on an average day, add the Options Volume Filter to your scan and enter 1000000 in the maximum field in the Windows Specific Filters Tab.

-

To find stocks that are trading between 5,000 and 100,000 option contracts on an average day, add the Options Volume Filter to your scan and enter 5000 in the minimum field and 100000 in the maximum field in the Windows Specific Filters Tab.

Using the Average Options Volume in Trading

The average options volume of a stock can provide valuable insights into market sentiment and potential price movements.

-

This filter enables traders to highlight stocks that have a consistent level of options trading activity.

-

Incorporating stocks with varying options trading volume into a portfolio can provide diversification benefits.

-

High-volume stocks might offer short-term trading opportunities.

-

Moderate-volume stocks could be considered for longer-term investments.

-

The average options volume of a stock is, however, just one piece off the puzzle, and is best use in combination with other alerts and filters. Especially useful is the Options Volume Today % Filter, which compares today's options volume to the normal options volume of a stock, enabling traders to identify stocks with a sudden increase in options trading volume.

FAQs about Options Volume

Can I scan for stocks based on options traded today instead of the average daily volume?

Yes, you can use the Options Volume Today Filter to scan for stocks based on the number of puts and calls traded today. This filter provides insights into options trading activity on a daily basis.

How can I find stocks with a sudden spike or drop in options trading volume?

To find stocks with unusually high options volume today, when compared to a normal day, use our Options Volume Today % Filter.

A sudden increase in options trading volume could suggest an upcoming event or news announcement. A significant drop might indicate a decrease in interest or reduced volatility. Combine this information with news and technical analysis to better understand the context and potential implications.

How can I interpret a sudden spike or drop in options trading volume for a stock?

A sudden increase in options trading volume could suggest an upcoming event or news announcement. A significant drop might indicate a decrease in interest or reduced volatility. Combine this information with news and technical analysis to better understand the context and potential implications.

Why are some stocks traded as options while others are not?

The decision to trade stocks as options or not depends on several factors, including the popularity of the stock, market demand for options contracts, investor interest, and the underlying company's characteristics. Here are some key reasons why some stocks are actively traded as options, while others may not have options available:

-

Liquidity and Volume: Stocks that are highly liquid and actively traded in the stock market are more likely to have options available. Liquidity ensures that there is a sufficient number of buyers and sellers for both the underlying stock and the associated options contracts. Traders and investors are more inclined to trade options on stocks with high liquidity to ensure smooth execution and tighter bid-ask spreads.

-

Market Capitalization: Large-cap stocks, or companies with a high market capitalization, tend to have a larger investor base and greater market interest. These stocks are more likely to have options available due to the demand from institutional investors, hedge funds, and retail traders.

-

Volatility and Price Movements: Stocks with higher volatility are more attractive for options trading because options' value is influenced by price fluctuations. Stocks that experience significant price swings offer potential profit opportunities for options traders through strategies like straddles and strangles.

-

Earnings and Events: Companies with upcoming earnings releases, product announcements, or other significant events are more likely to have active options trading. Traders use options to hedge or speculate on potential price movements around these events.

-

Industry Influence: Certain industries, such as technology and finance, tend to have more active options trading due to the dynamic nature of the sectors and the variety of investment strategies that options offer.

-

Regulatory Approval: Options trading is subject to regulatory approval, and not all stocks are eligible to have options contracts listed on them. Regulatory bodies evaluate factors such as market capitalization, trading volume, and investor interest before approving options trading on a specific stock.

Can I use the Options Volume Filter to identify potential options trading strategies?

While the Options Volume Filter primarily focuses on identifying stocks based on options trading activity, it can indirectly assist in developing options trading strategies. For instance, stocks with higher options volume may present opportunities for strategies like covered calls, protective puts, or directional trades.

Filter Info for Options Volume [PCAV]

- description = Options Volume

- keywords = Changes Daily

- units = Contracts

- format = 0

- toplistable = 1

- parent_code =