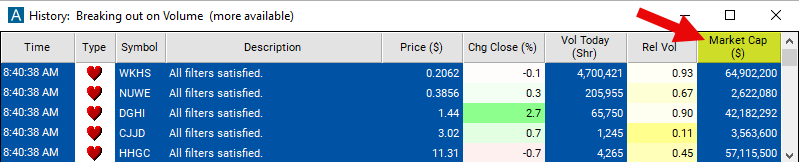

Market Cap

Table of Contents

Understanding the Market Cap Filter

The market capitalization (market cap) filter in stock trading is a tool used to filter and analyze stocks based on their total market value. Market cap is calculated by multiplying a company's current stock price by its total outstanding shares. It represents the total dollar value of a company's outstanding shares and is a crucial metric for investors assessing a company's size and value within the market.

Here's a breakdown of how the market cap filter works:

Market Cap Categories: Stocks are typically categorized into different market cap segments, including:

- Large Cap: Companies with a market cap exceeding $10 billion are considered large-cap stocks. They are often well-established companies with stable revenue streams and widespread recognition.

- Mid Cap: Companies with a market cap between $2 billion and $10 billion are classified as mid-cap stocks. They are usually established companies that may still have room for growth and expansion.

- Small Cap: Companies with a market cap between $300 million and $2 billion are classified as small-cap stocks. These companies are often younger and may have higher growth potential but also higher volatility.

Filtering Stocks: The market cap filter allows traders and investors to screen stocks based on their market cap. Users can set specific criteria to focus on stocks within a particular market cap range or exclude stocks outside their target range.

Investment Strategy: Market cap plays a crucial role in investment strategy. Investors may choose to allocate their portfolios across different market cap segments based on their risk tolerance, investment objectives, and market outlook.

Market Cap Filter Settings

Configuring the "Market Cap" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

-

Adjust the minimum value to 10,000,000,000 to see only stocks with a large market cap.

-

Adjust the maximum value to 300,000,000 to see only stock with a small market cap.

Using the Market Cap Filter

The "Market Cap" filter can be used in various trading strategies, including:

Sector Rotation: Investors may use the market cap filter to rotate their investments across different sectors based on market cap categories. For example, during economic downturns, investors may favor large-cap stocks in defensive sectors like healthcare and utilities. Conversely, during economic expansions, they may allocate more capital to small-cap and mid-cap stocks in cyclical sectors like technology and consumer discretionary.

Growth vs. Value: The market cap filter can help investors implement growth or value investing strategies. Growth investors may focus on small-cap and mid-cap stocks with high growth potential, while value investors may seek large-cap stocks that are undervalued relative to their intrinsic value. By filtering stocks based on market cap, investors can identify opportunities that align with their preferred investment style.

Portfolio Diversification: Market cap filtering can facilitate portfolio diversification by ensuring exposure to stocks across different market cap segments. Diversification helps spread risk and reduces portfolio volatility. Investors may allocate a portion of their portfolio to large-cap stocks for stability, while allocating smaller portions to mid-cap and small-cap stocks for growth potential.

FAQs

What is Market Capitalization (Market Cap)?

- Market capitalization represents the total value of a company's outstanding shares of stock. It is calculated by multiplying the current market price of a single share by the total number of outstanding shares. Market cap provides a measure of a company's size and is commonly categorized into large-cap, mid-cap, and small-cap segments.

How is Market Cap Used in Stock Trading?

- Market cap is used by investors and traders to categorize stocks based on size and risk profile. Large-cap stocks typically belong to well-established companies with stable earnings and lower volatility, making them suitable for conservative investors. Mid-cap and small-cap stocks represent companies with higher growth potential but also higher risk due to greater volatility.

What Are the Pros and Cons of Investing in Different Market Cap Categories?

- Large-cap stocks offer stability and liquidity but may have limited growth potential. Mid-cap and small-cap stocks have higher growth potential but may be more volatile and less liquid. Investors should consider their risk tolerance, investment objectives, and time horizon when allocating capital across different market cap segments.

Filter Info for Market Cap [MCap]

- description = Market Cap

- keywords = Fundamentals Changes Daily

- units = $

- format = 0

- toplistable = 1

- parent_code =