Earnings Date

Table of Contents

- Understanding the Earnings Date Filter

- Earnings Date Filter Settings

- Using the Earnings Date Filter

- FAQs

Understanding the Earnings Date Filter

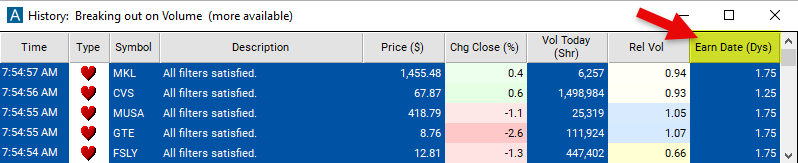

The earnings date respresents how long (in days) until the next earnings report. 0 means midnight this morning. 1 means midnight tonight / tomorrow morning. We do not count weekends, so -10 means 2 weeks ago.

Earnings Date Filter Settings

Configuring the "Earnings Date" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

- Earnings reporting sometime today: Min=0 Max=1

- Earnings reporting tomorrow: Min=1 Max=2

- Earnings reported yesterday: Min=-1 Max=0

- Earnings reporting this week: Min=0 Max=5

- Earnings reporting next week: Min=5 Max=10

- Earnings reported last week: Min=-5 Max=0

Using the Earnings Date Filter

The "Earnings Date" filter can be used in various trading strategies, including:

Earnings Momentum Trading: This strategy involves taking positions before the earnings announcement based on expectations of positive or negative earnings surprises. Traders may buy shares of a company expected to beat earnings estimates or short sell shares of a company expected to miss estimates. Positions are usually closed shortly after the earnings announcement to capture short-term price movements.

Event-Based Trading: Traders focus on trading opportunities arising from the earnings event itself. They may enter positions before the announcement and exit immediately afterward, aiming to capitalize on short-term price movements driven by the earnings release.

Post-Earnings Drift: This strategy involves taking positions based on the historical tendency of stocks to continue trending in the direction of the earnings surprise after the announcement. Traders may enter long positions in stocks that beat earnings estimates, expecting positive momentum to continue in the subsequent days or weeks. Conversely, they may short sell stocks that miss earnings estimates, anticipating continued downward pressure on the stock price.

FAQs

Why are earnings dates important in stock trading?

- Earnings dates are crucial because they mark the release of a company's financial results, providing investors with valuable information about its performance and future prospects. These announcements often lead to significant price movements in the stock, presenting trading opportunities and influencing market sentiment.

How do earnings announcements affect stock prices?

- Earnings announcements often lead to volatility in stock prices as investors react to the company's financial results and guidance. Positive earnings surprises, where actual earnings exceed expectations, can lead to stock price increases, while negative surprises may result in declines. The magnitude of the price movement depends on the degree of deviation from analysts' forecasts and market expectations.

What should I consider when trading around earnings dates?

- When trading around earnings dates, it's essential to consider factors such as analysts' forecasts, historical earnings performance, industry trends, and market sentiment. Additionally, traders should be aware of the potential risks, including volatility, liquidity constraints, and unexpected developments that may impact their positions.

Filter Info for Earnings Date [EarningD]

- description = Earnings Date

- keywords = Fundamentals Changes Daily

- units = Days

- format = 2

- toplistable = 1

- parent_code =