Call Volume Today

Table of Contents

- Understanding the Call Volume Today Filter

- Call Volume Today Filter Settings

- Using the Call Volume Today in Trading

- FAQs about Call Volume Today

Understanding the Call Volume Today Filter

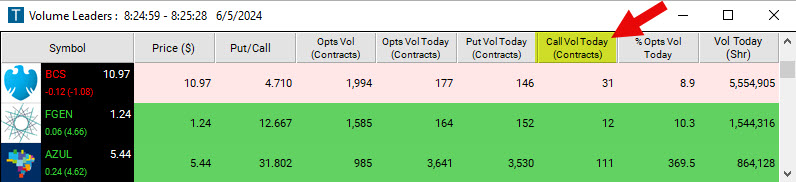

The Call Volume Today Filter enables traders to scan for stocks based on the number of calls traded so far today. This filter checks the actual number of contracts, not a percentage.

Call options grant holders the right, but not the obligation, to buy a stock at a certain price (strike price) before a specific date. A trader buying a call believes the stock's price will increase, while the seller is wagering it will stay the same or decrease.

Given that buying a call is generally a bullish move, our icon for this points upwards. Remember, for every buyer, there is a seller, so interpret these signals wisely.

Call Volume Today Filter Settings

Activating the Call Volume Today Filter is easy. You'll find its settings under the Window Specific Filters Tab in your Alert/Top List Window's Configuration Window.

You can define a minimum and/or maximum value, and stocks outside of your parameters are automatically excluded from your scan results.

-

To identify stocks that have traded at least 200,000 call options today, add the Call Volume Today Filter to your scan and input 200000 in the minimum field in the Windows Specific Filters Tab.

-

To spot stocks that have traded no more than 50,000 call options, add the Call Volume Today Filter to your scan and register 50000 in the maximum field in the Windows Specific Filters Tab.

-

For stocks that have already traded between 250,000 and 750,000 calls today, add the Options Volume Filter to your scan and enter 250000 in the minimum field and 750000 in the maximum field in the Windows Specific Filters Tab.

Using the Call Volume Today in Trading

The Call Volume Today Filter provides traders a direct perspective into daily activities surrounding call options for stocks. By aptly setting and interpreting the filter, traders can discern prevailing market sentiments, assisting in more informed decisions.

-

Spotting Bullish Sentiment: If a stock indicates a significant number of calls traded for the day, it could signify a prevailing bullish sentiment. This could be driven by anticipated positive news, upcoming earnings reports, or general market optimism.

-

Detecting Potential Sell Opportunities: A notably low number of calls traded might indicate a lack of bullish sentiment. This could be a cue to evaluate bearish strategies.

-

Aligning with Technical Indicators: If a stock displays high call volume and is nearing a significant resistance level or showing other bullish patterns, this might solidify a decision to adopt a bullish strategy.

-

Sector Analysis: High call volume in numerous companies within a sector might hint at a bullish outlook for the entire sector. Consider strategies to capitalize on sector-wide growth.

-

Integrating with Liquidity Filters: Using the Call Volume Today Filter alongside liquidity filters ensures the stocks pinpointed have adequate trading activity for smooth position entries and exits.

-

Highlighting Highly Traded Stocks: An unusually high call volume for a stock can suggest that it's currently under the limelight. Events like news, earnings reports, or industry developments might be the cause. A trader should cross-check with other sources to gauge if the high call volume is justified or mere speculation.

-

Combining with Put Option Filters: Integrating the Call Volume Today Filter with the Put Volume Today Filter and the Put/Call Ratio Filter offers a complete snapshot of the option market's stance on a stock. High call and put volumes together hint at possible volatility, paving the way for strategies that capitalize on price movements in either direction.

FAQs about Call Volume Today

What does a high call volume indicate for a stock?

A high call volume reveals many traders or investors are engaging in call options for that stock on a particular day. Generally, buying a call option is a bullish action, hinting at an expectation of the stock's price appreciation.

Why should I pair the Call Volume Today Filter with other indicators?

The Call Volume Today Filter grants raw data on call options traded. Pairing it with other tools can deliver a broader and more nuanced grasp of market direction and sentiment.

Does elevated call volume always imply a bullish sentiment?

Not always. Although buying a call is conventionally a bullish action, it's crucial to recognize that for every call buyer, there's a seller. It could be possible that the sellers foresee the stock not rising above the call's strike price. Always resort to comprehensive research and analysis.

How does the Call Volume Today Filter compare to other volume-oriented filters?

This filter specifically zeroes in on the volume of call options traded for stocks on that day, without making percentage comparisons or relating to the stock's primary trading volume. Such direct insights are invaluable for traders aiming to grasp market sentiment based on call option dynamics.

How should I interpret simultaneous high volumes in both call and put options for a stock?

This usually signals increased activity or interest, possibly linked to an imminent event or news. It conveys a split market sentiment, with some anticipating a stock price hike and others a decline.

How does stock liquidity influence decisions based on the Call Volume Today Filter?

Liquidity embodies the ease of trading an asset without significantly impacting its price. High call volume combined with low liquidity can make trade execution challenging at desired levels. High liquidity ensures more seamless trades and minimal price shifts.

How do I distinguish between speculative calls and hedging calls?

Speculative calls are pursued anticipating stock appreciation, while hedging calls are to safeguard against potential losses. The Call Volume Today Filter won't distinguish between the two, but diving into other data points or news can offer clarity.

How do I deploy the Call Volume Today Filter in trending versus sideways markets?

In an uptrend, high call volume can corroborate the trend's strength. In a stagnant market, a surge in call volume could indicate a potential upward breakout. Always meld these findings with other technical analysis instruments for optimal accuracy.

Filter Info for Call Volume Today [CTV]

- description = Call Volume Today

- keywords =

- units = Contracts

- format = 0

- toplistable = 1

- parent_code = PTV