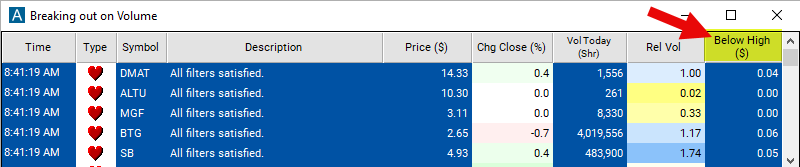

Below High

Table of Contents

Understanding the Below High Filter

The "below high" filter is used to identify stocks whose current price is below their recent high price within a specified timeframe. This filter is commonly used by traders to spot potential trading opportunities, particularly in identifying stocks that may have experienced a recent pullback or are trading below recent resistance levels.

This filter is not available before the market opens.

This filter is similar to the position in range filters. Both show how close the current price is to the high of the day. But there are several differences.

- The below high filter always quotes the price in dollars while the position in range filters quote the price as a percentage.

- The below high filter uses 0 for the high of the day. The position in range filters use 100.

- In the below high filter, a higher number corresponds to lower stock price. In the position in range filters, a higher number corresponds to a higher stock price.

Below High Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here is how to setup the filter in your configuration window:

-

Set the max below high filter to a small number to find stocks which are currently trading close to the high of the day. Use the min below high filter to find stocks which are not currently trading close to the high of the day. For example, set the max below high filter to 0.07 to find stocks which are trading no more than 7 cents below the high of the day.

-

Use negative numbers to find stocks trading above the high of the day. This is possible, especially after market hours. The high of the day only includes official prints, and ignores most pre and post market activity. For example, set the max to -0.05 to find stocks which are trading at least 5 cents above the official high of the day.

Using the Below High Filter

Several trading strategies can be employed with the Below High filter. Here are a few examples:

Mean Reversion: Some traders employ mean reversion strategies when stocks trade below their recent high prices. They anticipate that the price will revert back towards its average or historical highs after experiencing a deviation. These traders may enter positions expecting the price to return to its previous high levels.

Breakout Confirmation: Traders may use the "below high" filter to confirm breakout trading opportunities. When a stock breaks out above its recent high, traders may wait for a pullback where the price falls below the recent high before entering a long position. This filter can help confirm the validity of the breakout and provide a more favorable entry point.

Trend Reversal: Stocks trading below their recent high prices may indicate a potential reversal in trend. Traders may look for signs of a trend reversal, such as bullish candlestick patterns or bullish divergence in oscillators, to enter contrarian positions with the expectation that the stock will reverse its downward trend and move towards its previous high levels.

Range Trading: Traders may employ range trading strategies when stocks trade below their recent high prices. They identify stocks that are trading within a defined price range between the recent high and low levels and enter positions near the support level, anticipating a bounce back towards the recent highs.

FAQs

What does the "below high" filter indicate?

- This filter identifies stocks whose current price is below their recent high price within a specified timeframe. It helps traders identify potential trading opportunities based on stocks that have pulled back from their highs.

Why is the "below high" filter important in trading?

- This filter is important because it helps traders identify potential buying opportunities in stocks that have experienced pullbacks or corrections from their recent highs. It allows traders to capitalize on potential reversals or bounce-backs in price.

What trading strategies can be used with the "below high" filter?

- Traders can employ various strategies, such as pullback trading, mean reversion, breakout confirmation, trend reversal, range trading, and volume analysis, when using the "below high" filter. Each strategy may be suitable for different market conditions and trader preferences.

How should I interpret stocks that are below their recent highs?

- Stocks trading below their recent highs may indicate potential buying opportunities, especially for traders who believe in buying low after a pullback. However, traders should conduct further analysis to confirm the strength of the setup and consider other factors such as market trends and overall market sentiment.

Filter Info for Below High [BelowHigh]

- description = Below High

- keywords = Highs and Lows Single Print

- units = $

- format = p

- toplistable = 1

- parent_code =