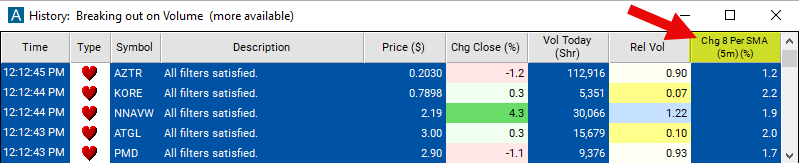

Change From 8 Period SMA (5m)

Table of Contents

- Understanding the Change From 8 Period SMA 5m Filter

- Change From 8 Period SMA 5m Filter Settings

- Using the Change From 8 Period SMA 5m Filter

- FAQs

Understanding the Change From 8 Period SMA 5m Filter

The "Change From 8 Period SMA 5m Filter" is an indicator that looks at the current price of a stock relative to its 8-period Simple Moving Average (SMA) on a 5-minute chart. It is tailored for short-term, intraday trading by highlighting immediate price trends. Here’s a breakdown of its components:

Simple Moving Average (SMA)

8-Period SMA on a 5-Minute Chart: This SMA calculates the average closing price of a stock over the last 8 five-minute periods, giving a total span of 40 minutes. It serves to smooth out price fluctuations on a very short-term basis.

Calculation: The values entered for this filter are percentage (%). The formula is (Percent Change) = ((Last Price) - (SMA)) / (SMA) * 100.

A positive number means that the current price is above the moving average. A negative number means the current price is below the moving average.

Change From 8 Period SMA 5m Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here is how to setup the filter in your configuration window:

-

Set the min value to 1 to see only stocks in which the current price is above their 8 period SMA on a 5 minute chart.

-

Set the max value to -1 to see only stocks in which the current price is below their 8 period SMA on a 5 minute chart.

Using the Change From 8 Period SMA 5m Filter

Several trading strategies can be employed with the Change From 8 Period SMA 5m filter. Here are a few examples:

Momentum Trading: Traders might look for a significant positive change as an entry signal for a long position, interpreting it as upward price momentum. Conversely, a significant negative change might signal a potential short opportunity.

Reversion to Mean Strategies: If the stock price deviates notably from the 8-period SMA, some traders may expect the price to revert to the mean (the SMA) and trade accordingly.

Scalping: Because the filter reflects very short-term changes, it's useful for scalping strategies where traders seek to profit from small price changes, quickly entering and exiting trades.

Stop Loss and Take Profit: The 8-period SMA can serve as a dynamic level to manage stop loss and take profit orders, adjusting them in real-time with the moving average.

FAQs

How is the "Change From 8 Period SMA (5m)" different from the 2-minute version?

- The "Change From 8 Period SMA (5m)" spans a longer timeframe, covering the last 40 minutes of trading with each period being 5 minutes long. This makes it slightly less reactive to immediate price changes than the 2-minute version, providing a broader view of short-term price momentum.

Can the "Change From 8 Period SMA (5m)" be used for all trading styles?

- While particularly useful for day traders and those employing short-term trading strategies, its effectiveness might vary with different trading styles. Scalpers may find it too slow, whereas swing traders might use it for additional confirmation of intraday trends.

How do I interpret a consistent positive or negative change from the 8-period SMA on a 5-minute chart?

- A consistent positive change suggests sustained upward momentum, possibly indicating a strong buy signal. Conversely, a persistent negative change can indicate downward momentum, potentially signaling a sell or short opportunity. However, confirmation from other indicators and market context is crucial.

How can I adjust the filter for higher volatility stocks?

- For stocks with higher volatility, consider using additional filtering criteria like a minimum percentage change.

Filter Info for Change From 8 Period SMA (5m) [5SmaLa8]

- description = Change from 8 Period SMA (5m)

- keywords = Fixed Time Frame Moving Average

- units = %

- format = 1

- toplistable = 1

- parent_code = 2SmaLa8